US Energy Forecast for 2025: Transportation Sector Overview

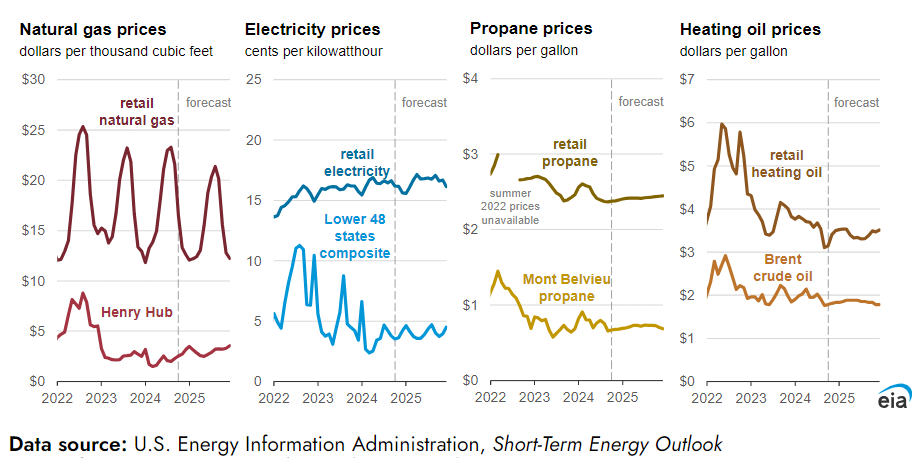

As we approach 2025, the U.S. energy consumption is expected to experience notable changes across various sectors, particularly in heating, transportation, and fuel consumption. Most U.S. households are expected to spend the same or less on energy this winter, according to data from the U.S. Energy Information Administration (EIA). However, the actual price of diesel will vary depending on demand of fuel type, geographic region, and weather patterns. These volatile & dynamic factors will impact overall energy inventory levels across the country.

Looking ahead to 2025, the EIA anticipates retail diesel prices will average around $3.50 per gallon, a 5% drop from earlier predictions. The agency also reduced its wholesale diesel price forecast for the fourth quarter by 11.2%, with prices now expected to average $2.06 per gallon. In 2025, wholesale diesel prices are projected to decline further, averaging $2.30 per gallon, down 8.4% from previous estimates.

Minimal Increase in Retail Diesel Prices:

- Despite a slight increase due to the Midwest harvest season, the national average diesel price rose only by 4 cents to $3.584 per gallon as of October 7.

- This small rise follows 10 consecutive weeks of decline, and the year-over-year price is down by 91.4 cents.

Outlook for 2025 Diesel Prices:

- EIA forecasts diesel prices to remain stable, averaging $3.54/gallon in Q4 2024 and $3.53/gallon in early 2025. This forecast on diesel pricing is lower than prior estimates by 4%. The average annual forecast for retail diesel price average, according to the EIA, is $3.50/gallon throughout 2025.

- Wholesale diesel price forecasts for Q4 2024 were also cut by 11.2%, now expected to average $2.06 per gallon. The current price is about $2.40.

- Wholesale diesel is projected to average $2.30 per gallon in 2025, an 8.4% drop from earlier estimates.

Global Diesel Demand Weakening:

- Diesel demand is declining globally, especially in China, where Chinese oil demand is currently firmly in contraction, falling by 1.7%, or 280 000 b/d, year‑on‑year in July, a marked contrast with the 9.6% average pace of growth in 2023. It only continued to drop further in September.

- China invested heavily in a high speed rail network which has reduced demand for air travel, along with investments in vehicles powered by alternative fuels which has reduced oil demand for road transportation.

- This decline is attributed to a slowdown in economic activity, reduced construction, and a shift toward liquefied natural gas (LNG) as a fuel for heavy-duty trucks.

Trends in Fuel Economy and Gasoline Consumption

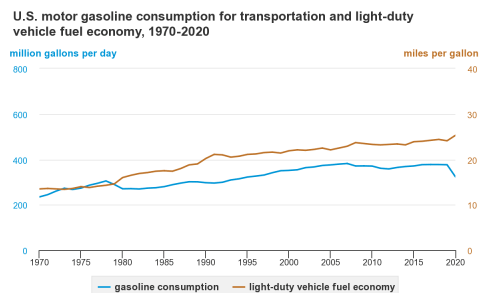

The United States is a nation constantly on the move, and transportation is a key driver of energy consumption. In 2022, about 27% of total U.S. energy consumption went towards moving people and goods across the country. This reliance on transportation fuels, predominantly gasoline and diesel, has profound implications on transportation pricing.

Despite advancements in fuel efficiency, gasoline consumption has continued to rise. Federal fuel economy standards have helped improve the average fuel economy of light-duty vehicles, which include passenger cars, pickup trucks, vans, and SUVs. But this progress has been offset by the increasing number of vehicles on the road—particularly larger, less fuel-efficient vehicles such as SUVs, crossovers, and light pickup trucks—and the growing number of miles driven per vehicle.

This trend highlights the challenges of reducing overall gasoline consumption even as technology advances to improve fuel efficiency. Addressing this issue requires not only continued improvements in fuel economy but also a broader shift towards alternative fuels and transportation solutions.

Major Types of Energy Used in U.S. Transportation

As the U.S. looks to the future of transportation energy, the role of alternative fuels will become increasingly important. Biofuels, natural gas, and electricity offer cleaner, renewable options that can reduce greenhouse gas emissions and dependence on imported petroleum. Electric vehicles, in particular, hold the potential to transform the transportation sector, especially as infrastructure improves and battery technology advances.

In addition, natural gas is gaining traction in specific segments, such as heavy-duty trucks and buses, due to its lower emissions and cost advantages. Over time, as more industries and consumers shift towards these cleaner energy sources, the U.S. will move closer to a more sustainable and energy-independent future.

Ultimately, while petroleum remains the dominant fuel for transportation today, the transition to alternative fuels is already underway.

Looking forward, petroleum and other liquid fuels will continue to dominate the transportation sector, accounting for around 88% of total energy use. However, their share will decline slightly as alternative fuels, especially natural gas, gain prominence. Natural gas consumption in transportation is projected to grow significantly, particularly in large trucks, buses, and light-duty vehicles. By 2040, natural gas will power 15% of large trucks, 50% of buses, and 7% of light-duty vehicles, according to EIA projections.

Although motor gasoline will remain the largest transportation fuel in 2025, its overall share is expected to decline over time. Diesel fuel, including biodiesel, will also see its market share dip, while jet fuel consumption is set to increase modestly.

Currently, the U.S. uses about 20 million barrels of oil each day, with 98% of vehicles on the road running on petroleum-based fuels like gasoline and diesel. This translates into roughly a staggering 2.3 trillion miles driven by Americans each year.

However, this heavy reliance on petroleum comes with drawbacks, particularly in terms of energy security. The U.S. imports nearly 20% of its petroleum supply, making the country vulnerable to global oil market fluctuations and price volatility. As a result, there is growing interest in cheaper, renewable alternatives that can reduce dependence on imported oil and help achieve a more sustainable energy future.

- Petroleum Products: This category includes gasoline, diesel, jet fuel, residual fuel oil, and propane, which are derived from crude oil and natural gas processing. Petroleum is the most heavily used energy source in the transportation sector, accounting for about 90% of total energy use in 2021.

- Biofuels: Renewable biofuels, such as ethanol and biomass-based diesel, contributed around 6% of the energy used for transportation. These fuels are produced from organic materials and offer a cleaner alternative to traditional fossil fuels.

- Natural Gas: Natural gas, which contributed about 4% of the total energy used in transportation, is primarily used in pipeline compressors. However, its use is growing in vehicles such as buses, trucks, and fleet vehicles, thanks to its cost-effectiveness and lower emissions.

- Electricity: Although still a minor player in the transportation sector, electricity powers some mass transit systems and electric vehicles (EVs). In 2021, electricity accounted for less than 1% of total energy use in transportation. However, as EV adoption increases and mass transit systems expand, electricity will likely play a larger role in the future of transportation.

As innovation continues and infrastructure develops, cleaner, renewable energy sources will increasingly take center stage in the U.S. transportation landscape, offering a pathway toward reduced emissions and greater energy security.

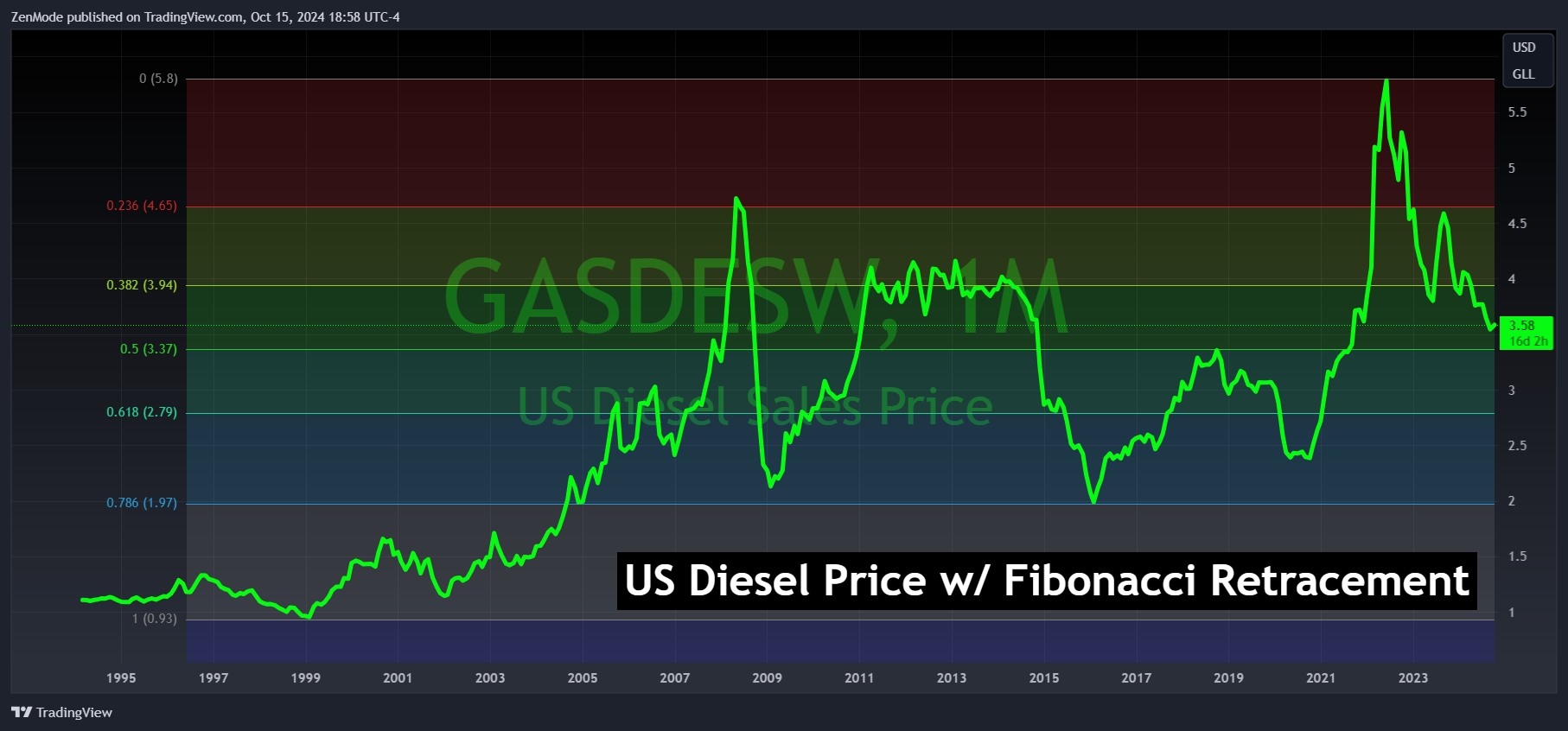

Technical Analysis Concerning US Diesel Pricing

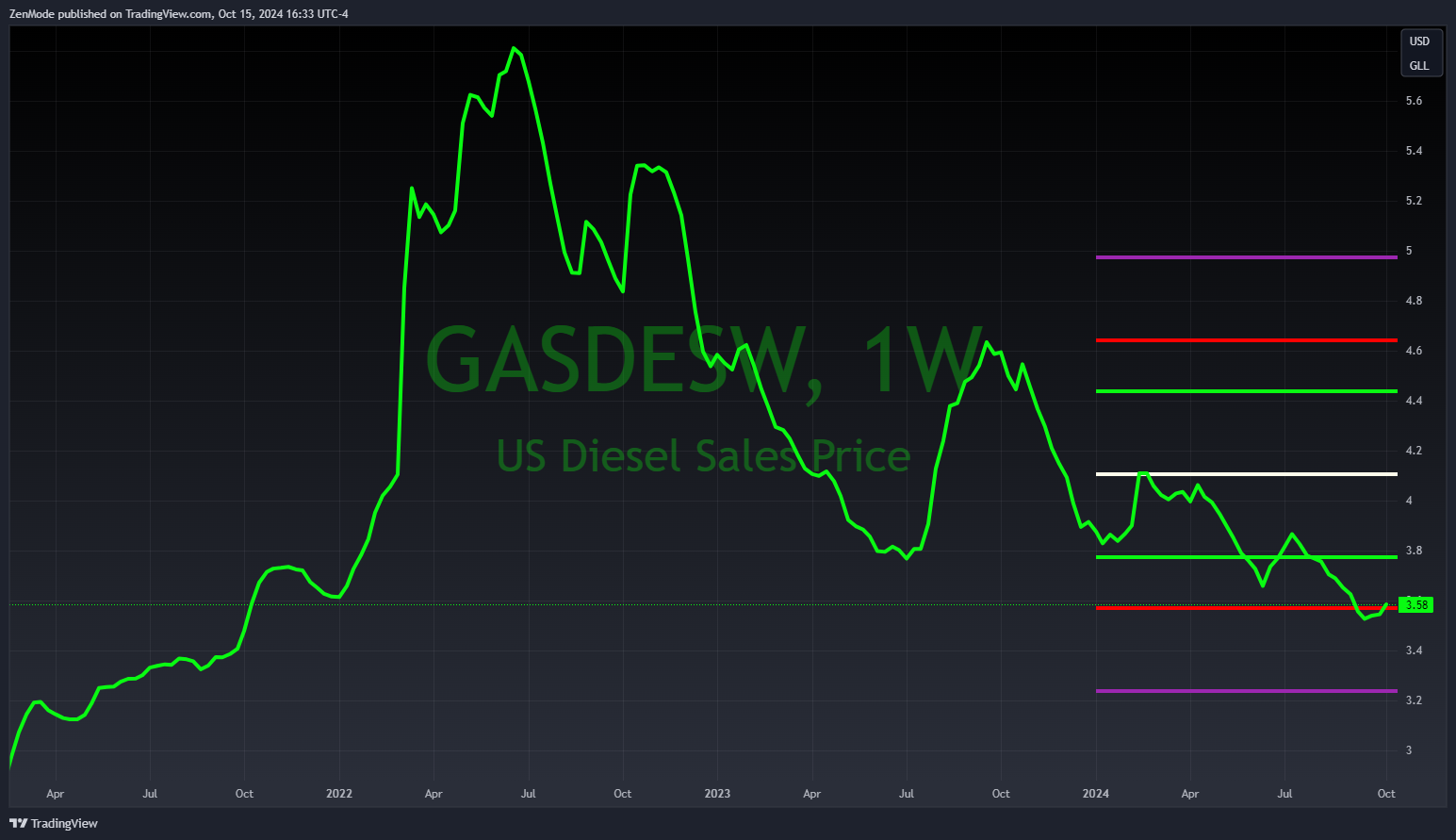

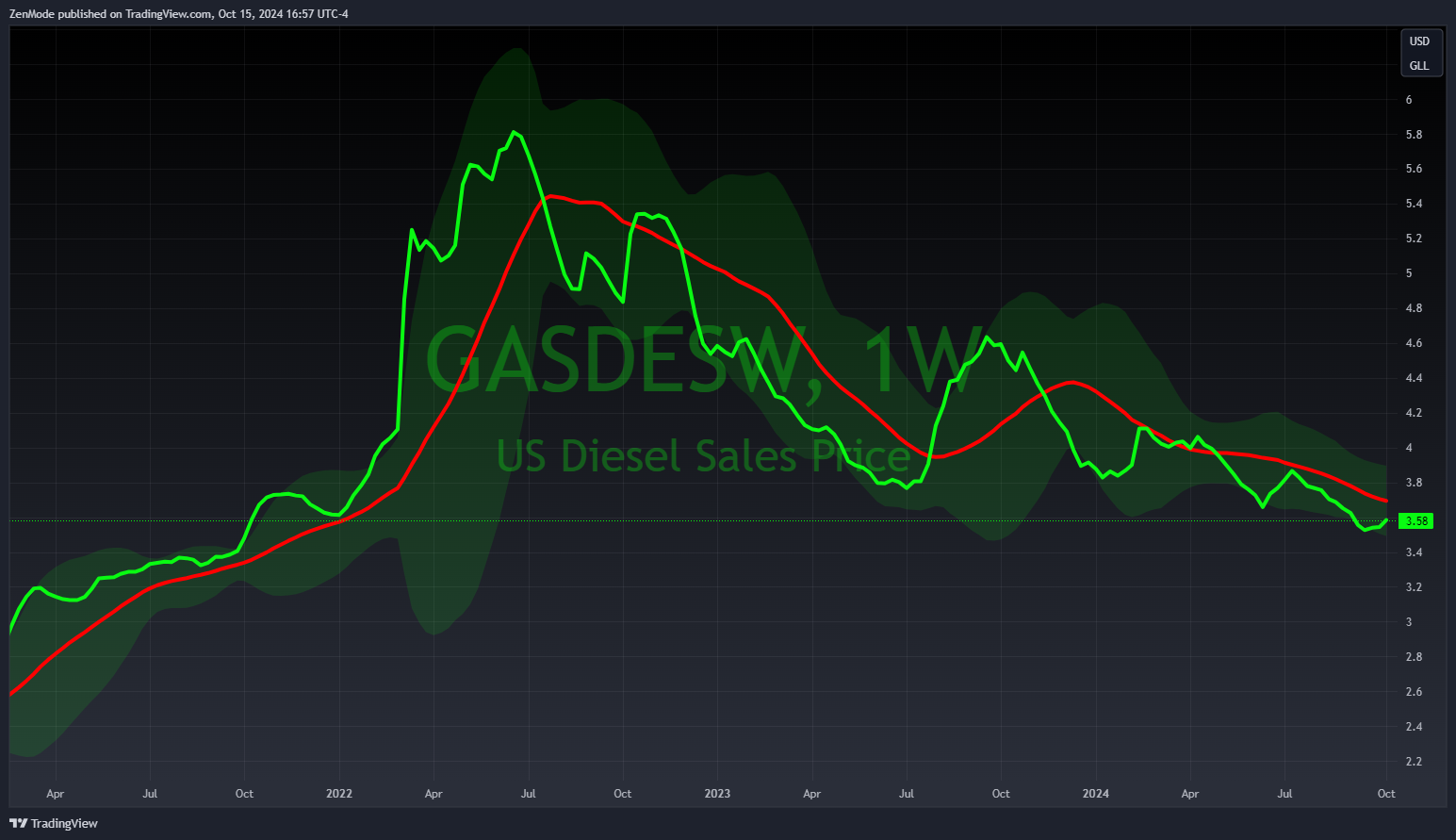

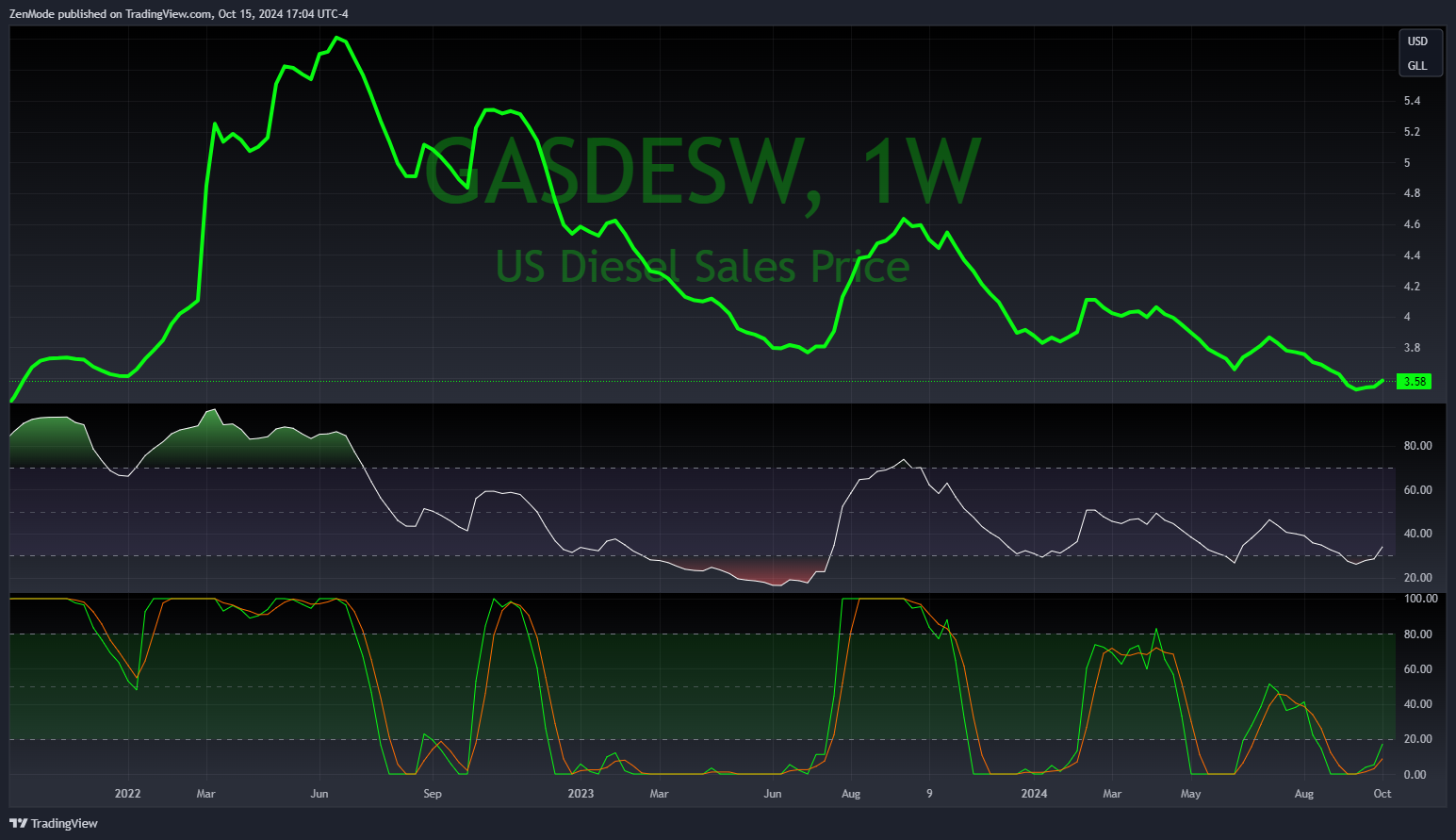

As of today, the price of U.S. diesel sits at $3.58 per gallon, aligning with the S2 support level based on Fibonacci pivot points. Technical analysis indicates that the S3 support zone is $3.24, while S1 is $3.78, marking key areas for potential price movement. On the weekly chart, the Bollinger Bands show the mean price sloping downward, reflecting the current bearish trend in diesel prices.

Within 2024, diesel prices have tagged the 2-standard deviation line (lower Bollinger Band) before retracing to the mean (red line), as seen in April and July 2024. With colder months approaching, there may be a temporary uptick in demand, but prices are likely to face renewed pressure afterward. The slope of the mean continues to drop deeper. Once could speculate that price will rise into the mean before dropping further.

Both RSI (Relative Strength Index) and STOCH (Stochastic Oscillator) suggest that US Diesel may have been in oversold territory, with the RSI showing a bounce from below 30 and STOCH indicating a recent crossover from its lower range. This signals a potential short-term and seasonal price reversal before the downward trend is likely to resume.

Despite these volatile fluctuations, it’s important to note that TLI negotiates contracts with the motor carriers where fuel remains a pass-through cost, meaning it doesn't serve as a profit center for the carrier but also doesn't require expensive hedging strategies. TLI continues to monitor fuel surcharges closely to ensure efficient, cost effective operations in the transportation market.

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email