Who are the Largest LTL Freight Companies?

Largest LTL Freight Companies

Determining who the "largest" LTL companies are proves tricky. The term "largest" refers to several different factors: market capitalization of public companies, the volume of drivers, the number of terminals, or the number of employees. Given these varying criteria, this article makes a comprehensive aggregation look at the major players in the LTL industry.

LTL Companies

Key Carriers in the LTL Industry

FedEx Freight

FedEx Freight is one of the major players in the less-than-truckload (LTL) shipping industry. They offer two main service levels - economy and priority. The economy service provides reliable but basic shipping at a lower cost for non-time-sensitive freight. Priority service, on the other hand, guarantees faster transit times and delivery by a specific day for shipments that are more urgent. FedEx prides itself on maintaining a nationwide network with accurate freight tracking capabilities.

While FedEx Freight is known for providing good overall service quality, their pricing model does not necessarily make them the most economical LTL carrier option. Their rates tend to be competitive for long-haul, national shipping lanes where their operational scale provides some advantages. However, for more regional or localized shipments, FedEx can sometimes be outpriced by more regionalized carriers.

To combat this, many shippers utilize FedEx for long-haul transport but engage TLI's regional LTL carriers for shorter shipping zones where they can find better pricing. This blended approach allows shippers to leverage FedEx's reputable service for the long-haul portion while keeping overall costs down by using regional carriers better suited for more localized freight movements. With careful modal optimization, shippers can take advantage of FedEx's strengths while maintaining cost competitiveness.

Old Dominion Freight Line

Old Dominion Freight Lines stands out as a logistics powerhouse with an impressive market capitalization of $37.51 billion and a workforce of 22,902 employees. This company epitomizes LTL operational excellence, boasting a staggering 21.19% net profit margin and an equally impressive 34.12% gross margin. These remarkable financial metrics underscore Old Dominion's position as likely the best-run LTL company from a financial administration standpoint. However, customers pay a premium for this level of operational prowess.

Renowned for delivering incredible service levels, Old Dominion fearlessly tackles freight that other LTL carriers might avoid due to complexity or challenges. Their extensive network and commitment to customer satisfaction enable them to handle even the most demanding shipments with ease. This unparalleled level of service comes at a cost, as Old Dominion prices their offerings at a premium to match the value they provide.

Clients who entrust their freight to Old Dominion consistently express high levels of satisfaction with the service they receive. The company's dedication to meeting and exceeding customer expectations has earned it a reputation for reliability and dependability. While their rates may be higher than alternative LTL carriers, Old Dominion's unwavering commitment to excellence justifies the investment for businesses that prioritize seamless logistics and outstanding customer experiences.

XPO Logistics

XPO Logistics has solidified its position in the LTL market through strategic acquisitions, including the established Conway brand. This $12.16 billion company (by market cap) with 23,300 employees has successfully integrated Conway's operations while maintaining its excellent service reputation. With a net margin of 3.08% and a gross margin of 10.5%, XPO demonstrates sound & stable financial management in the LTL space. Shippers who utilize XPO as their primary national LTL carrier generally express satisfaction with the service levels, citing friendly and prompt drivers as a strength.

A key differentiator for XPO is their technological capabilities, enabling TMS integration with logistics providers like TLI. This allows for automated tendering of shipments and real-time tracking across XPO's network. The company's former CEO and current Executive Chairman, Brad Jacobs, is a well-respected figure in the industry known for his leadership. XPO moves an impressive 18 billion pounds of freight annually while maintaining competitive pricing and a reputation for good service quality. Under Jacobs' guidance, the company has strategically positioned itself as a formidable & growing player in the LTL market.

Saia Motor Freight

From its origins as a regional carrier, Saia has successfully transformed into a formidable national presence in the LTL freight industry. With a workforce of 14,000 employees, Saia has strategically executed an expansion plan that has allowed it to establish a comprehensive network reaching across the United States. This growth has been backed by strong financials - as a public company, Saia boasts an impressive $12.07 billion market capitalization.

Saia's meteoric rise has been supported by robust profitability metrics, including a 12.42% net profit margin and a 16.14% gross margin. These healthy margins demonstrate the company's ability to drive operational efficiencies as it scales its national network. Throughout this expansion, Saia has generally maintained a positive reputation among shippers for reliable service. By coupling its broadened geographic coverage with consistent delivery quality, Saia has cemented itself as a major national player in the LTL market.

T-Force

TForce Freight, a subsidiary of TFI International (TFII), emerges as a prominent American LTL freight carrier headquartered in Richmond, Virginia. Tracing its roots back to 1935 when it was founded as Overnite Transportation, the company underwent a rebranding in 2006 to UPS Freight after its acquisition by UPS. In 2021, UPS sold the company to TFI, leading to its current name, TForce Freight. With a market capitalization of $11.62 billion and a workforce of 25,116 employees, TForce boasts impressive financial metrics, including a 15.28% gross margin and a 6.44% net margin, reflecting its stability and administrative prowess.

TForce Freight has pioneered innovative pricing models in collaboration with TLI, spearheading the shift from traditional freight class-based pricing to LTL density based pricing. This groundbreaking approach has resonated tremendously with TLI's shipper customers, streamlining logistics processes and delivering significant cost savings. TForce's willingness to embrace cutting-edge technology solutions underscores its commitment to continuous improvement and customer-centric service delivery. TLI warmly welcomes shippers to experience the benefits of this transformative pricing model firsthand.

Estes Express

Estes Express Lines stands as a formidable force in the LTL industry, boasting a workforce of 20,000 employees. As a privately held company, financial information is not readily available to the public. However, the company's operational scale and reputation speak volumes about its success. Estes has been a family-run business, with Robey Estes serving as President in 1990 and later ascending to the role of Chairman in 2001. Currently, his son Webb Estes leads the company as President, ensuring a seamless transition of leadership.

I had the privilege of meeting Robey Estes personally at NASTRAC, and his commitment to exceptional service and shipper satisfaction left a lasting impression. Known for his shipper-oriented approach, Robey Estes has cultivated an incredible reputation within the industry. Under his guidance, Estes Express has solidified its position as the largest privately held LTL company, a testament to the company's unwavering dedication to excellence.

With a vast fleet comprising 6,700 tractors, 240 terminals, and 30,000 trailers, Estes Express boasts an extensive network capable of handling substantial freight volumes efficiently. The company's reputation for operational prowess is further bolstered by its significant investments in technology, ensuring seamless logistics operations and real-time visibility for customers. In the wake of Yellow Corporation's Chapter 11 bankruptcy and impending liquidation, Estes Express placed an initial stalking horse bid of $1.3 billion for Yellow's terminals, underscoring its ambitions for continued growth and market dominance.

ABF Freight

ABF Freight stands as a prominent national LTL carrier with deep roots dating back to the 1920s. Originally operating as 'OK Transfer', the company acquired 'Arkansas Motor Freight' (AMF) in the 1930s, kicking off a growth trajectory through strategic acquisitions. This legacy organization thrived, acquiring Navajo Freight Lines in the 1970s and undergoing a leveraged buyout in the 1980s before going public again in the 1990s.

In 2014, ABF Freight rebranded under the ArcBest Corporation umbrella, solidifying its position as a diversified logistics powerhouse. Since then, ArcBest has continued its acquisition strategy, purchasing companies like Beart Transportation Services and Smart Lines Transportation Group. Today, ABF Freight operates as the anchor LTL division within ArcBest, boasting 15,000 employees and a market capitalization of $2.48 billion.

From a financial standpoint, ABF Freight demonstrates steady performance with an 8.53% gross margin and a 2.75% net margin. These metrics highlight the company's ability to generate profitability while scaling its nationwide network. ABF Freight's longevity and acquisition history have shaped a carrier with a rich legacy and unwavering commitment to service excellence.

TLI has cultivated a strong relationship with ABF Freight, particularly due to the carrier's early adoption of LTL dynamic pricing models readily available to TLI's shipper customers. This partnership exemplifies ABF Freight's forward-thinking approach and willingness to embrace innovative solutions that streamline logistics processes and enhance customer experiences.

Best LTL Companies

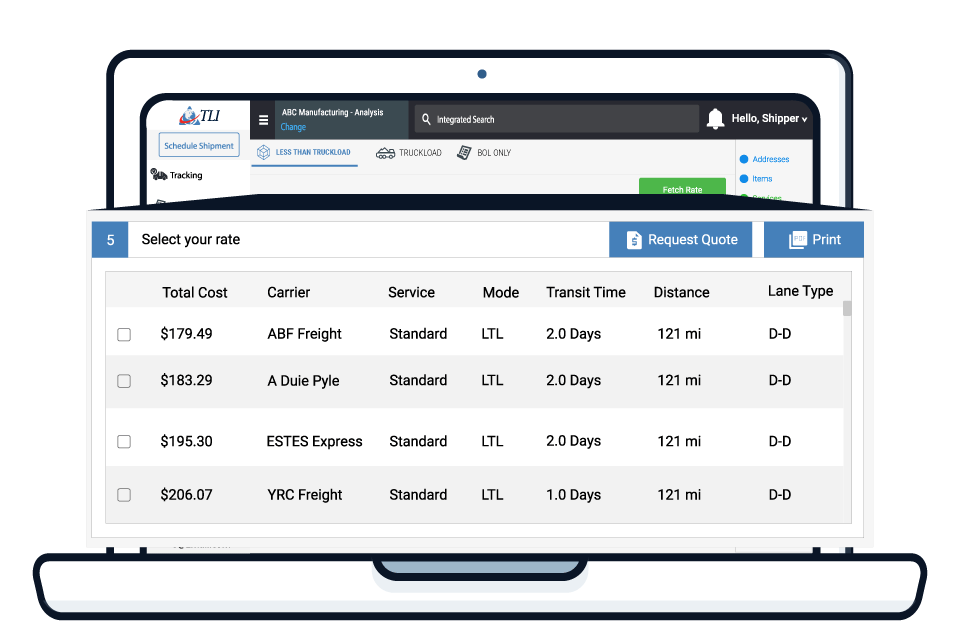

Given the different ways to measure "largest," it’s essential to consider multiple factors. By aggregating various metrics like market cap, driver volume, number of terminals, and employee count, we can get a clearer picture of the industry's leading companies. At TLI, we recognize the strength and capabilities of these industry giants. We offer competitive pricing and enable shippers to compare carriers side-by-side, helping them make the best choices for their shipping needs.

There are many other fantastic LTL companies out there that we haven’t mentioned. This isn't due to any lack of appreciation or preference. At TLI, we partner with and onboard every LTL carrier, including regional LTL carriers, not just the national ones. With so many more LTL carriers available, partnering with TLI ensures you can access them all in one aggregated rating view through our transportation management system.

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email