News and Analysis for Transportation Industry Shippers

Shippers’ Reliance on Freight Brokers

The proliferation of freight brokerages is giving truckers a lifeline during an unprecedented freight recession. In 2000, freight brokerage was a small niche, representing just 6% of the trucking industry. By 2023, freight brokers handle over 20% of all transport trucking freight, making them mainstream scalability contributors.

Freight brokerages have significantly reshaped the typical freight cycle. In the early 2000s, brokers were rarely in primary positions on shippers’ routing guides, often handling undesirable freight that asset-based carriers rejected. However, investments in TMS technology and customer service have allowed brokers to offer a superior product, earning them a greater role in routing guides. Today, multiple freight brokerages often occupy top spots in routing guides, handling high-quality, carrier-friendly freight.

Impact of the Motor Carrier Act of 1980

Shippers now rely heavily on brokers' extensive databases of reliable carriers to ensure timely shipments. As of April 2023, the U.S. had over 531,000 active trucking fleets with at least one tractor. This shift is rooted in the Motor Carrier Act of 1980, which deregulated the trucking industry, leading to the rise of freight brokerages.

Before deregulation, the Interstate Commerce Commission (ICC) tightly controlled the trucking industry, setting rates and routes and even dictating the types of freight that could be hauled. This regulation stifled competition and kept freight rates high. The Motor Carrier Act of 1980, supported by President Jimmy Carter and Congress, removed these restrictions, fostering competition and leading to lower shipping rates and increased use of backhauls.

Post-Deregulation Growth and Evolution

Post-deregulation, carriers began operating wherever they could find profitable freight, and many relied on freight brokers to secure backhauls. This need for backhaul freight spurred the growth of professional freight brokerages. Many larger carriers also started in-house brokerage divisions to create additional revenue streams and control demand pools.

Today, freight brokers act as traffic managers for shippers and sales agents for carriers, responsible for thousands of daily freight transactions. Efficient brokerages can reduce transportation costs for shippers and increase carriers' revenue. The number of motor carriers has exploded since deregulation, with 99% operating 100 or fewer trucks, and almost 97% operating fewer than 10 trucks. Small carriers often rely on brokerages for sales and customer service roles, gaining a continual stream of freight.

Freight Brokerages During Economic Downturns

During the 2008 freight recession, brokerages represented just 10% of the total freight market. This percentage has since doubled, with brokerages playing key roles in routing guides and benefiting small carriers. The number of trucking companies grew by 28% from 2019 to 2022, driven by pandemic-induced high rates. However, as capacity increased, rates fell, forcing new entrants to accept lower rates to keep their trucks moving.

In past cycles, a soft freight market led to a massive purge in capacity. However, the proliferation of freight brokers has slowed this process. Unlike previous down cycles, brokers have maintained high load volumes even as rates fall, positioning themselves as core carriers.

The pandemic saw a surge in new freight brokers, with roughly 300,000 active freight brokers at the start of 2023. However, by October of 2023, the number of active and authorized brokerages had decreased by 5.6% from the previous year. Despite low-paying loads, brokers supply carriers with enough work to cover expenses, keeping them in business longer.

Proliferation of Small Carriers

From 2010 to August 2020, the trucking industry added an average of 199 new fleets per week. This number skyrocketed to 1,124 new fleets per week from August 2020 to September 2022. The market currently has 63,000 more fleets than historical trends would suggest. Since September 2022, the market has seen an average of 435 fleets per week churning. FreightWaves models indicate it will take 78 weeks for capacity to balance with historical trends, assuming no acceleration in revocations.

Future Predictions and Market Trends

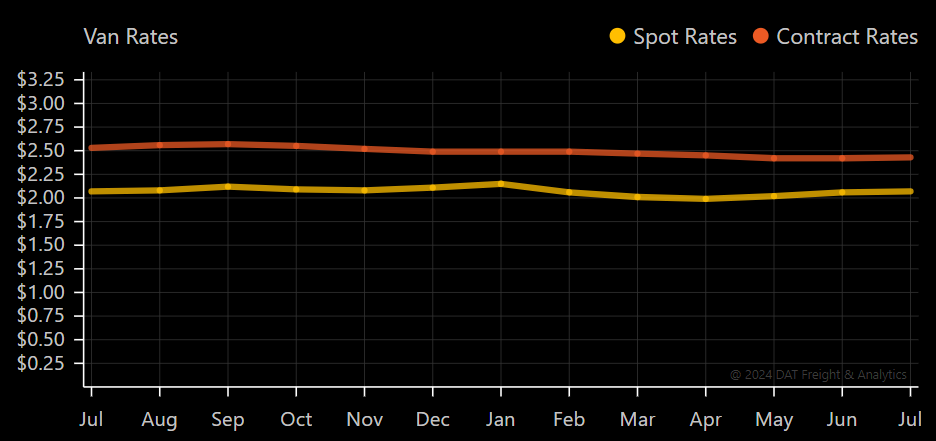

Many analysts predict freight rates won't increase until at least the third quarter of 2024, with only modest rises expected. This ongoing attrition will continue to weed out the weakest players. Bid season is different this year, with less-than-truckload shippers needing strong options or rebidding networks affected by Yellow's earlier troubles. Spot rates are low, leading to soft contract rates and shrinking margins, exacerbating financial issues for brokerages.

The Outbound Tender Market Share Index highlights markets with the most impact on truck volumes, showing where demand is strongest. Network imbalances can create spot market activity, making it crucial for carriers to partner with Translogistics Inc. Our analytics pinpoint ideal markets and pricing strategies, helping shippers & carriers navigate this challenging environment effectively, and data-driven.

Dominance in Freight Movement

- Trucks transport approximately 72.6% of the nation's freight by weight.

- In 2022, trucking generated $940.8 billion in gross freight revenues (primary shipments only), accounting for 80.7% of the nation’s freight bill.

- Trucks moved 11.46 billion tons of freight (primary shipments only) in 2022, representing 72.6% of the total domestic tonnage shipped.

Fuel Taxes and Costs

- Commercial trucks paid $29.12 billion in federal and state fuel taxes in 2021.

- As of January 2023, the federal fuel tax rates are 24.4¢ per gallon of diesel and 18.4¢ per gallon of gasoline.

- State fuel taxes average 33.9¢ per gallon of diesel and 31.6¢ per gallon of gasoline.

Fleet and Mileage Statistics

- In 2021, there were 13.86 million single-unit (2-axle, 6-tire or more) and combination trucks registered, making up 5% of all motor vehicles registered.

- These trucks traveled 327.48 billion miles in 2021.

Transport Industry Composition

- The trucking industry is primarily made up of small operations: 95.8% of fleets operate 10 or fewer trucks, and 99.7% operate 100 or fewer trucks.

- Trucks carried 83.5% of the value of surface trade between the U.S. and Mexico in 2022.

- The transportation industry employed 8.4 million people in 2022, excluding the self-employed.

Economic Indicators and Trucking Trends

- The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index decreased by 1.6% in June after a 3% increase in May.

- In June, the index stood at 113.5 (2015=100), down from 115.3 in May.

- Growth mode, but the rate of growth stalled.

- Despite June’s decline, the second quarter average was 0.2% higher than the first quarter, indicating a slow recovery since a recent low in January.

Strategic Shipping Summary

Given the current market conditions and the gradual improvement in truck freight tonnage, it may be a prudent time for Translogistics Inc (TLI) to secure carrier contracts and implement scalable managed transportation solutions, and launch your data-driven transportation RFP in anticipation of a potential capacity crunch in 2025-2026.

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email