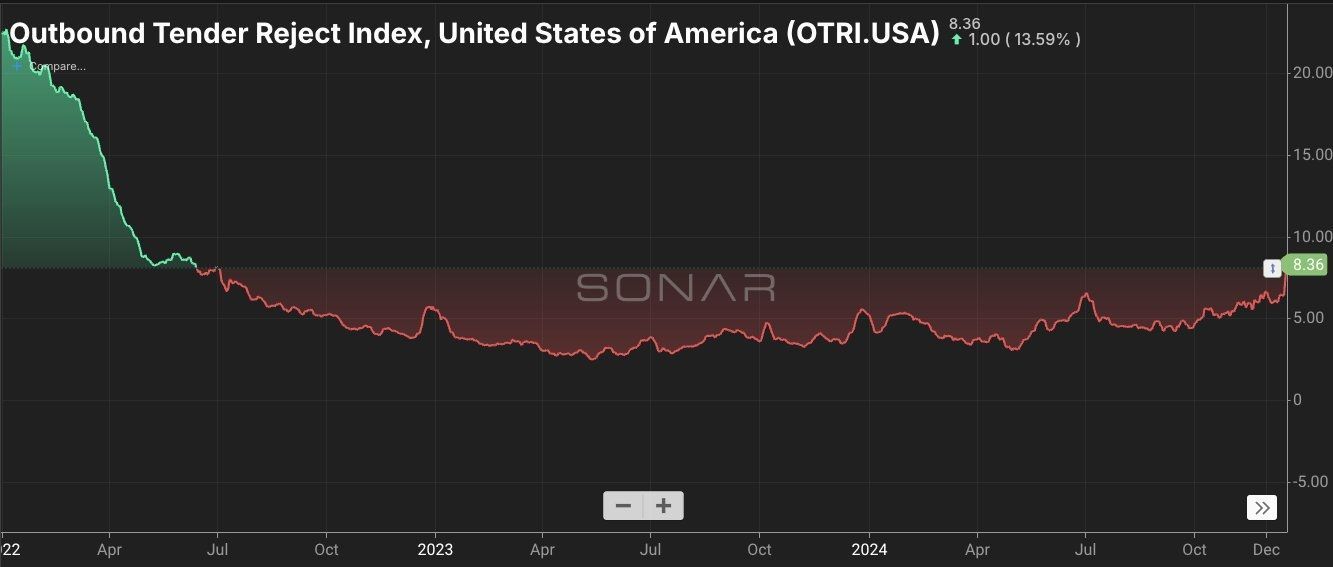

Outbound tender rejection rates (OTRI) measure the percentage of freight loads that carriers reject relative to total tenders. A rising OTRI often signals improving market conditions for carriers because it indicates that their capacity is filling up, giving them the leverage to negotiate higher rates.

Today, OTRI has surged to levels not seen since June 2022—a time when many dismissed signs of an impending freight recession. The rapid climb from the 7% range into the mid-8% range represents what some might call a "tender rejection short squeeze," where demand outpaces available capacity faster than expected.

This uptick suggests a rebound in spot market rates per mile, which have been heavily compressed over the past year. Carrier costs, combined with capacity constraints, are finally forcing shippers to pay more. Additionally, new drug-clearinghouse regulations, which disqualify non-compliant drivers, are likely contributing to tighter capacity. These regulations are removing drivers from the workforce, creating fewer available trucks and amplifying upward pressure on rates.

The current shift may mark the beginning of a more favorable pricing environment for carriers after a prolonged period of suppressed margins. This surge in tender rejections creates a feedback loop in the $/mile pricing structure. As more carriers lock themselves into long-term contracts, fewer trucks remain available in the spot market. This reduction in competition in the spot market drives up rates as shippers compete for limited capacity. The higher tender rejections further intensify this cycle, signaling tighter capacity and supporting rate increases. According to DAT iQ, this dynamic is expected to stabilize and push rates upward steadily, with projections indicating significant gains by the second quarter of 2025. This trend underscores the importance of monitoring capacity and market shifts closely as conditions evolve.