U.S. Manufacturing Sector Expands for a Second Month

Key Highlights from the February ISM Report

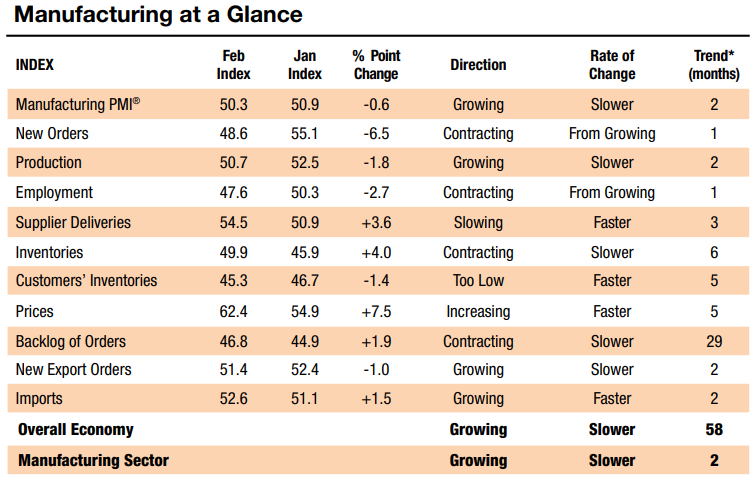

The U.S. manufacturing sector continued its expansion in February, marking the second month of growth following 26 months of contraction. According to the latest Manufacturing ISM Report On Business, the Manufacturing PMI registered 50.3%, slightly down from January’s 50.9%, but still signaling overall growth.

Manufacturing PMI Holds Above 50%

The Manufacturing PMI registered 50.3%, reflecting a slight decline of 0.6 percentage points from January but maintaining expansion. Over the last four months, the index has risen by four percentage points, signaling a gradual recovery. While this is a positive sign for the industry, some underlying trends show areas of concern.

One of the biggest setbacks in February was the New Orders Index, which fell back into contraction territory at 48.6% after three months of growth. This sharp 6.5 percentage point drop from January’s 55.1% suggests that demand is weakening. At the same time, production remained in expansion mode, with the Production Index at 50.7%, though it slowed slightly from January’s 52.5%.

Manufacturers are also facing rising costs. The Prices Index surged to 62.4%, up 7.5 percentage points from January. This jump suggests that businesses are paying significantly more for raw materials, which could lead to higher prices for consumers in the coming months. Meanwhile, order backlogs improved slightly, with the Backlog of Orders Index rising to 46.8%, but they are still shrinking overall.

It is also worth advising that employment in the MFG sector took a hit, with the Employment Index dropping to 47.6% from January’s 50.3%. This means manufacturers are cutting jobs after a brief hiring streak, signaling potential concerns about future demand.

Despite these mixed signals, ten industries reported growth in February, including petroleum and coal products, primary metals, food and beverages, electrical equipment, and transportation equipment. Inventory levels also showed signs of stabilizing, with the Inventories Index inching up to 49.9%, reflecting a slower rate of contraction bordering on expansionary levels.

Trade activity remained positive, with both exports and imports increasing. The New Export Orders Index came in at 51.4%, marking a second straight month of growth, while imports climbed to 52.6%, suggesting higher demand for foreign goods and materials.

Overall, the manufacturing sector is still growing, but the slowdown in new orders and rising prices could pose challenges in the months ahead. Companies will need to carefully navigate these pressures while keeping an eye on shifting demand and cost fluctuations.

Inflation Eases Concerns Over ISM Price Surge

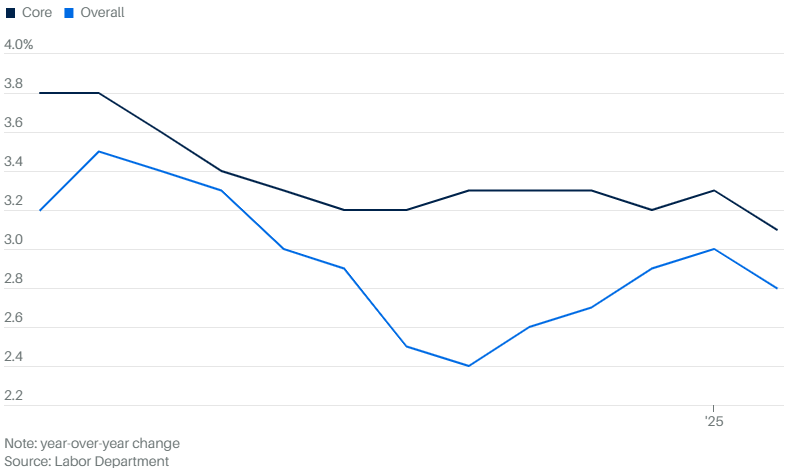

As we just mentioned, February's ISM Prices Index surged to 62.4%, a 7.5 percentage point increase from January, raising concerns that inflationary pressures were accelerating. This jump signaled that manufacturers were paying significantly higher costs for raw materials, fueling fears of broader price increases. However, fresh Consumer Price Index (CPI) data released today eased those worries, showing that inflation is cooling more than expected.

Key CPI Numbers to Know:

- Year-over-Year (YoY): Consumer prices rose 2.8% (vs. 2.9% expected).

- Month-over-Month (MoM): Prices increased 0.2% (vs. 0.3% expected).

- Core YoY (Excluding Food & Energy): Up 3.1% (vs. 3.2% expected).

- Core MoM: Increased 0.2% (vs. 0.3% expected).

Markets reacted positively to the data, relieved that inflation pressures weren’t as severe as feared. While the numbers marked the first decline in inflation readings since September, they are unlikely to prompt the Federal Reserve to lower interest rates just yet. The Fed remains focused on long-term inflation trends, and with prices still above the 2% target, policymakers are expected to hold steady at next week’s meeting. The good news however is that the trend does appear to indicate muted inflationary pressure.

Despite the softer inflation print, tariff policies under the Trump administration could keep price pressures elevated in the coming months according to some analysts. Goods prices rose 0.2% in February, an early sign that tariffs on Chinese imports may be pushing costs higher. Some experts argue that technology-driven efficiencies could offset these increases, creating underlying disinflation that gives the Fed more flexibility. However, if economic growth slows or labor conditions weaken, rate cuts may become a stronger consideration.

So in summary, the manufacturing sector is still growing, but the slowdown in new orders and rising prices could pose challenges in the months ahead. The underlying trend of inflation however does appear to be improving. Companies will need to carefully navigate these pressures while keeping an eye on shifting demand and cost fluctuations.

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email

Check out more Blog Posts from TLI:

Get a Quote

Customer Service

Contact Us

All Rights Reserved | TLI

Services

Support

Company

Services

Support

Company

Get a Quote

Support

Contact Us

All Rights Reserved | TLI