Cargo Liability

Cargo Liability

Cargo liability is essential for defining the responsibilities and protections in transporting goods. It involves the legal obligations and potential liabilities of those involved in moving cargo. Understanding cargo liability is crucial for everyone in the supply chain, whether by land, sea, or air.

What is Cargo Liability?

Cargo liability places legal responsibility on various parties involved in transporting goods. It specifies who bears the risk for potential loss, damage, or delay during transit, typically including carriers, freight forwarders, shippers, and other entities in the transportation process.

Cargo Liability is Unique to Mode Type

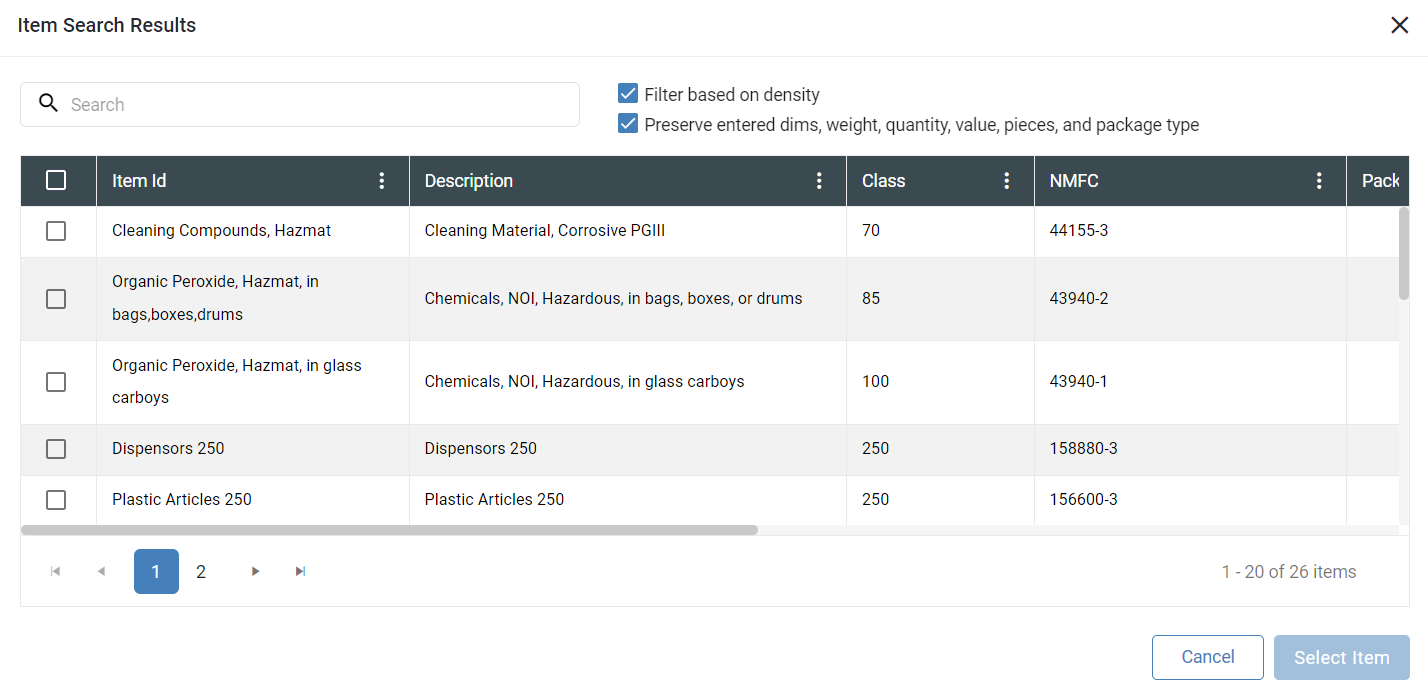

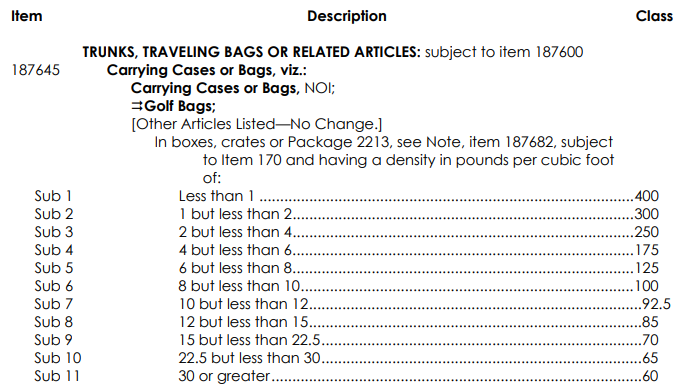

In the LTL market, cargo liability is often linked to the freight class of the goods being transported. Freight class is a standardized system that assesses the risk of specific cargo types based on factors like density, stowability, handling, and liability. This classification directly affects the carrier's liability, as they base their rates and coverage on the assigned freight class. Therefore, in the LTL market, freight class is a key factor in determining cargo liability, with carriers adjusting their rates and liability based on the assessed risk of the cargo.

n the Truckload market, where entire truck trailers are dedicated to a single shipment, cargo liability and coverage are handled differently. Truckload shipments typically come with a higher coverage limit, often around $100,000, provided by the carriers as a standard part of their service. Unlike in the LTL market, where liability is closely tied to freight class, truckload shipments offer substantial coverage regardless of the cargo's specific freight class. This higher coverage aims to provide comprehensive protection for the entire shipment, reflecting the greater volume and value of these larger-scale shipments.

Cargo Legal Liability Insurance

In the LTL market, liability is based on the freight class, leading to varied coverage amounts. In contrast, the Truckload market typically offers a standard higher coverage limit, aiming to cover the entire shipment regardless of the freight class. Shippers and stakeholders must understand these differences to ensure proper coverage, reduce risks, and make informed decisions. To hold carriers liable for damage, it's crucial to sign the delivery receipt accurately, noting any damage. If a delivery receipt is signed clear when there is damage, shippers may face financial losses and miss out on motor truck cargo legal liability. Even when freight claims are paid, settlements are usually only a small percentage of the claimed amount.

Truckload shipments often come with a standard coverage limit, such as $100,000. However, this coverage only applies to the actual value of the cargo. For example, if the cargo is valued at $12,000 and the entire load is lost, the compensation would be limited to $12,000.

This principle of indemnity in cargo insurance means the carrier or insurance provider compensates the shipper for the actual value of lost or damaged goods, up to the declared value. While the $100,000 limit offers higher protection for more valuable shipments, compensation is always tied to the actual value of the cargo. This prevents overcompensation and maintains fairness in claims settlements.

Understanding cargo claims is crucial for shippers and stakeholders. It highlights the importance of accurately declaring the value of the cargo to ensure realistic expectations about coverage in case of loss or damage during transit.

Cargo Liability Risks

Cargo liability involves various risks that can significantly affect compensation or coverage in case of loss, damage, or disputes during transportation.

- Insufficient Coverage: Inadequate coverage for the cargo's value poses a significant risk. For example, shipping a load worth $1 million with only $100,000 in liability coverage exposes the shipper to substantial financial risk. If part of the cargo sustains $500,000 in damage, the carrier's obligation is limited to the coverage amount, resulting in potential losses of $400,000 for the shipper.

- Signed Clear Delivery Receipts: Signing a delivery receipt without noting damage poses a risk, especially for concealed damage. If concealed damage is discovered later, carriers may offer minimal settlements due to the lack of documentation at delivery, making it difficult to prove liability.

- Poor Loading Practices: Improper loading can lead to carriers declining liability for damage. Carriers may refuse liability if they determine the freight was not loaded properly, placing responsibility on the shipper or consignee.

- Incorrect Labeling or Classification: Inaccurate labeling or misclassification can complicate liability claims. If freight is not properly labeled or documented, carriers might refuse full settlements, creating confusion about the nature of the goods and impacting liability.

- Recurring Cargo Claims: Frequent claims raise concerns about packaging or handling. If many shipments result in claims, carriers may attribute issues to inadequate packaging, shifting blame to the shipper and limiting liability.

Cargo Liability Parties

Carriers: Entities responsible for physically transporting cargo via truck, ship, airplane, or train. Carriers can be held liable for damage or loss during transit if negligence or mishandling is proven.

Freight Forwarders: They facilitate transportation, arranging shipments for shippers and collaborating with carriers. While not directly handling cargo, freight forwarders may assume limited liability under certain circumstances.

Shippers: Individuals or businesses sending goods. Shippers must correctly pack and label their cargo to meet safety standards. Failure to do so could impact their liability in case of damage.

Cargo Liability Insurance

Cargo liability insurance is a specialized insurance type crafted to protect the value of goods during transportation against damage, theft, or loss. It offers financial protection to shippers by covering the declared or actual cargo value, thus reducing the financial risks linked with shipping valuable goods.

Routing High-Value Freight

Comprehensive Coverage: Standard carrier liability may fall short in covering the full value of high-value shipments. Cargo liability insurance steps in, offering enhanced protection by covering the actual value of transported goods. This ensures that in case of loss or damage, the shipper receives adequate compensation, thus minimizing potential financial losses.

Customized Coverage: Cargo liability insurance allows for tailor-made solutions. Shippers can choose coverage limits that match the value of their shipments, ensuring a personalized and comprehensive level of protection.

Fill Coverage Gaps: Standard carrier liability often comes with limitations and exclusions. Cargo liability insurance bridges these gaps, extending coverage to various risks not covered by the carrier's liability, such as specific damages or unforeseen circumstances.

Reduced Financial Risk: High-value freight carries substantial financial risks if lost, damaged, or stolen during transit. Cargo liability insurance mitigates this risk by providing financial protection to the shipper, ensuring reimbursement for the actual value of the cargo and averting potential financial setbacks.

Acquiring Cargo Liability Insurance:

Declared Value vs. Actual Value: Accurately declaring the cargo's value to the insurer is crucial. Coverage is determined based on this declared or proven value. Underestimating the value may result in insufficient coverage in case of loss or damage. A common challenge shippers face when filing claims is requesting compensation based on the sale value rather than the cost of sourcing the material. It's a risk distributors should anticipate.

Policy Limitations and Exclusions: Understanding the terms, limitations, and exclusions of the insurance policy is vital. Some policies may have specific exclusions or conditions that affect coverage, emphasizing the need to thoroughly review policy details.

Risk Assessment and Mitigation: Insurers may require implementing risk assessment and mitigation measures. This could involve proper packaging, security measures, or compliance with transportation guidelines to minimize risks and qualify for comprehensive coverage.

Cargo Liability Types

- Carrier Liability: Generally governed by international conventions (such as the Hague-Visby Rules or the Warsaw Convention), carrier liability sets limits on the amount carriers are responsible for in case of loss, damage, or delay.

- Contractual Liability: Agreements between parties can establish specific liabilities beyond those set by conventions. Contracts often outline the extent of responsibility in case of loss or damage.

- Statutory Liability: Some jurisdictions have specific laws dictating cargo liability, adding further layers of responsibility or protection for parties involved in transportation.

Coverage

Declared Value: Shippers have the option to declare the value of their goods, which can impact the carrier's liability and transportation costs.

Insurance: Parties involved often choose cargo insurance to reduce risks. This coverage safeguards against theft, damage, or loss during transit.

Limits and Exclusions: It's crucial to note that cargo liability frequently comes with limits and exclusions. Factors such as inadequate packaging or the nature of the goods may exempt carriers from liability.

Understanding Cargo Liability

- Risk Mitigation: Knowing the extent of liability helps in making informed decisions to mitigate risks and protect against potential losses.

- Compliance: Adhering to regulations and agreements regarding cargo liability ensures compliance and minimizes legal disputes.

- Financial Protection: Proper understanding and coverage of cargo liability safeguard businesses from significant financial repercussions due to unforeseen events during transit.

Understanding cargo liability is crucial for all stakeholders involved in transporting goods. It defines responsibilities, reduces risks, and safeguards against potential losses, ensuring smoother operations within the logistics and shipping industry.

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email