What Are Tariffs?

A tariff is a tax on imported goods, paid by the U.S. business or individual receiving the shipment at the port of entry. These taxes apply only to physical products, not to services. When a shipment arrives, the importer covers the cost of the tariff before the goods move through customs.

Tariffs affect prices across the board. They raise costs for companies that rely on global supply chains, and those costs often pass on to consumers. Even businesses that make products domestically may feel the pressure, as competitors and suppliers react to new pricing dynamics.

Broad-based tariffs trigger retaliation. When the U.S. imposes high tariffs, other countries like China respond in kind, hitting American exports. Farmers, manufacturers, and workers often face the brunt of those countermeasures, with reduced demand and shrinking margins. Margin compression is realized when a company reduces the cost of their goods to offset the tax increase on consumers.

Recent Major Tariffs in Effect

Automobiles imported from any country are now subject to tariffs. As of April 3, these duties apply to finished vehicles. By May 3, they are expected to extend to all imported auto parts as well. This marks a significant cost shift for automakers relying on international sourcing.

The U.S. has introduced a sweeping 10% reciprocal tariff on all imported goods. Some countries face even steeper duties—up to 24% for Japan and 40% for certain Southeast Asian countries. These tariffs hit businesses across industries, from electronics to apparel and more. The sudden increase in tariffs has already changed behavior of domestic consumers and businesses. U.S. importers rushed to bring in goods before higher duties take effect. Shipping patterns have shifted, with many companies turning to countries outside China to avoid the heaviest penalties which has resulted in a large drop in tonnage imported from China.

Frequently Asked Questions Concerning Tariffs

Are goods already en route exempt from tariffs?

In some cases, yes. Products “on the water”—already loaded and in transit before the tariff effective date—may qualify for exemption. However, importers must provide documentation proving shipment timing.

Which tariffs have been paused?

Only the reciprocal tariffs above 10% are paused. The 10% base tariff still applies. Taken together, the current tariff environment represents the largest tax increase in over 50 years.

Which industries will see the biggest disruptions?

Advanced manufacturing sectors like aerospace, medical technology, and automotive will feel the deepest impact.

These industries rely on global inputs, and adjusting supply chains takes years. Even domestic industries, like cement and windows, will see rising costs. Small and mid-sized businesses face the most immediate pressure, as tariffs cut into already slim gross profit margins.

How do goods qualify for USMCA duty-free treatment?

The rules depend on the product. Simple items like lumber clearly originate from one country. Complex products, like autos, must meet specific “rules of origin” or undergo “substantial transformation” to qualify. Businesses should consult trade attorneys or customs brokers to stay compliant.

Are small business exemptions or reimbursements available?

No. The Trump administration has not established any formal process for exemptions or reimbursements. While some public statements hinted at possible flexibility, no official channels have opened. For now, businesses must plan for full enforcement.

Will products that were previously duty-free remain exempt?

Almost none will be exempt under the new tariffs. Previously, about half of imported goods entered duty-free. Now, only a few categories—such as semiconductors, pharmaceuticals, and specific lumber products—remain untouched. Energy and select minerals are among the rare exceptions.

Supply Chain Changes and Global Impact of Tariffs

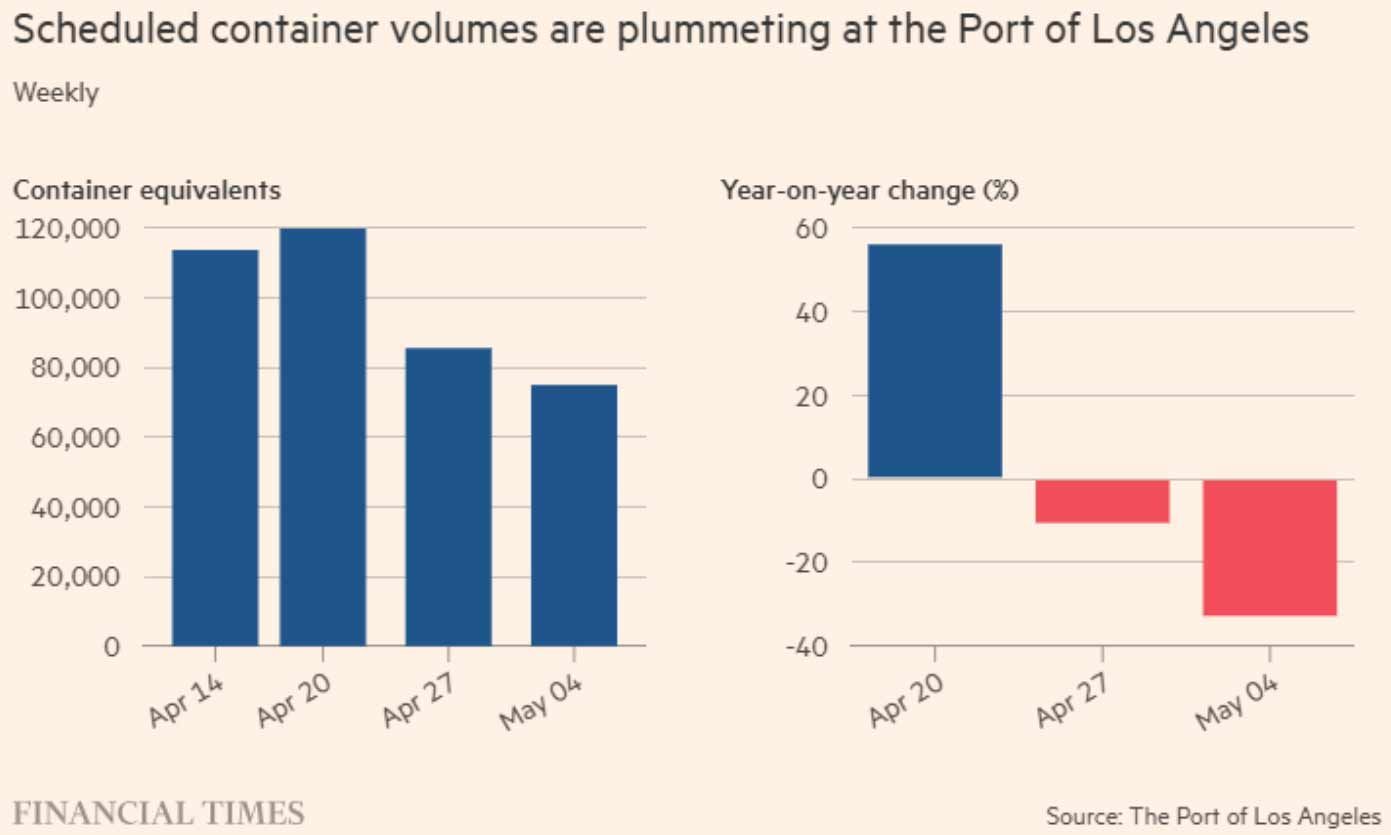

Shipping volumes between China and the U.S.

have recently plummeted. Some estimates report a 30% to 50% drop in recent weeks. In response, ocean carriers are canceling sailings and reducing capacity, particularly on West Coast and East Coast routes. The reduced capacity will keep rates temporarily elevated however there will be less domestic tonnage to route.

Many importers had stocked up ahead of the tariff deadline. This “frontloading” gave businesses some breathing room with having sourced additional inventory and raw material, but only for a limited time. U.S. shippers rely on a diverse group of countries to source products across critical industry sectors.

China continues to be the primary supplier of electronics, machinery, consumer goods, and toys, although many companies are diversifying due to tariffs and supply chain risk. If tariffs remain high, product shortages could follow—especially for categories like toys, baby goods, and sporting equipment, where China dominates manufacturing.

Vietnam has established itself as a top supplier for textiles and apparel, becoming a preferred sourcing hub for garments, fabric-based products, and footwear due to its competitive labor costs and growing manufacturing capacity. Mexico, leveraging its proximity and the benefits of the USMCA trade agreement, plays a key role in supplying automotive parts, machinery, and agricultural products, supporting just-in-time delivery strategies for North American supply chains.

Meanwhile, Canada remains a vital trade partner, particularly in energy (hydro) products, lumber, and industrial raw materials, due to its abundant natural resources and integrated cross-border logistics. Germany is a leading source of high-quality automotive products and precision-engineered machinery, offering reliability and engineering excellence for U.S. importers. Understanding the strengths of each trading partner helps shippers make more informed sourcing decisions, optimize freight strategies, and ensure resilience in their global supply chains.

Container prices briefly spiked after the reciprocal tariffs were announced. Prices out of Shanghai and Saigon jumped 40% before stabilizing. Since then, Shanghai-to-Long Beach rates

have dropped more than 30%, while prices from Vietnam have held steady. Air cargo rates, meanwhile, remain elevated due to exemptions for certain electronic goods and e-commerce products.