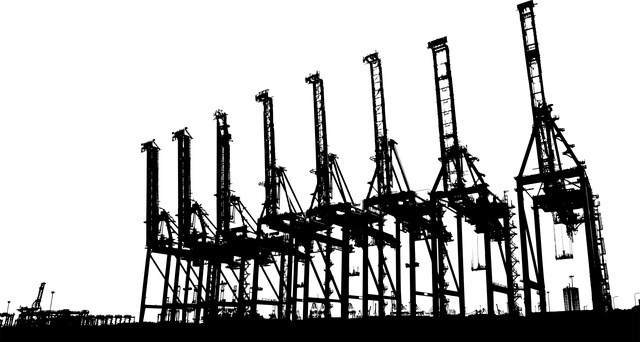

East and Gulf Coast Ports Strike: Impact on US Trade and Economy

Major U.S. Ports Affected by Strike

A large-scale labor strike has started at 14 major U.S. ports, including Boston, New York/New Jersey, Philadelphia, Wilmington, Baltimore, Norfolk, Charleston, Savannah, Jacksonville, Tampa, Miami, New Orleans, Mobile, and Houston. These ports handle approximately 43%-49% of all U.S. imports, moving billions of dollars in trade monthly. The International Longshoremen’s Association (ILA), the largest maritime union in North America, represents roughly 50,000 unionized longshoremen who are responsible for loading and unloading cargo at these ports.

ILA Rejects Wage Increase Offer

The strike, which began on October 1, has halted trade across the East and Gulf Coast ports, compounding issues caused by ongoing hurricane relief efforts. The ILA walked off the job after failing to reach an agreement with port management, marking their first strike since 1977. The ports and the U.S. economy are now facing severe disruptions as negotiations remain stalled.

The International Longshoremen’s Association rejected an offer from the United States Maritime Alliance (USMX) on September 30 that included a near 50% wage increase over six years. USMX also proposed doubling employer contributions to retirement plans and enhancing healthcare benefits. However, the ILA refused the offer, citing concerns over the continued use of automation at the ports. As a result, the strike began, affecting operations from New England to Texas.

The strike’s immediate financial impact is staggering, with hundreds of millions of dollars lost daily, particularly at major ports like New York/New Jersey. Despite hopes that the wage increase would lead to a resumption of bargaining, the strike has caused billions in trade to come to a halt. The economic repercussions are expected to be felt across industries, especially those reliant on just-in-time imports.

Economic and Political Impact of the U.S. Port Strike

With the official start of a strike across 14 major East and Gulf Coast ports, the U.S. economy faces significant disruptions. These ports are vital to both national and global trade, handling $3 trillion annually. According to the Conference Board, a one-week strike alone could cost the economy $3.78 billion, causing widespread supply chain delays and driving up the cost of consumer goods, particularly during the peak holiday shopping season. As prices rise, inflationary pressures could intensify, further straining household budgets.

The sheer scale of these ports makes it difficult for businesses to find alternative supply chain routes, creating a potential ripple effect across various industries, including retail, manufacturing, and pharmaceuticals. With so many sectors relying on timely imports and exports, a prolonged strike could lead to inventory shortages, delayed shipments, and rising costs for essential goods like food, medical supplies, and electronics.

Politically, the strike puts the administration in a challenging position just five weeks before the presidential election. The president could invoke the Taft-Hartley Act to force workers back, but this would be a risky move, likely alienating labor supporters. Automation also remains a major sticking point in negotiations, as both sides struggle to balance worker protections with technological advancements.

Impact on Supply Chain and US Economy

The timing of the strike is particularly detrimental, as the U.S. is also grappling with the aftermath of Hurricane Helene. Ports in Charleston and Savannah have faced delays and power outages, creating further congestion in ocean transportation, trucking, and rail carriers across the Southeast and Gulf regions. Experts warn that even a short strike could disrupt the supply chain for weeks, while a longer work stoppage could lead to significant shortages and price hikes.

Industries most affected include food, automotive, and pharmaceuticals, which depend heavily on the impacted ports. Pharmaceutical imports, retail goods, and generic medications are among the sectors most at risk from the strike. Major importers such as Walmart, Home Depot, and Ikea, which rely on these ports, will have limited options to divert their shipments. The pharmaceutical industry, in particular, is concerned as nearly 48% of active pharmaceutical ingredients (APIs) used in U.S. medications come from India, with many passing through East Coast ports.

Additionally, the ongoing strike could increase inflationary pressures, complicating the Federal Reserve's approach to interest rates. As mentioned before, a week-long strike is projected to cost the U.S. economy $3.78 billion, with supply chain delays continuing through mid-November. The strike has also affected the apparel and footwear industry, with over 53% of U.S. imports in this sector coming through these ports in 2023. Industry leaders warn that continued disruptions could severely affect inventory and retail operations, especially as the holiday season approaches.

Federal Government Involvement

The White House has taken steps to mediate the situation, involving senior officials such as Transportation Secretary Pete Buttigieg and Acting Secretary of Labor Julie Su. While efforts continue to bring both sides back to the negotiating table, the Biden administration has reiterated its refusal to invoke the Taft-Hartley Act, which could temporarily suspend the strike. "It's collective bargaining," Biden said. "I don't believe in Taft-Hartley."

Despite ongoing negotiations, the ILA and USMX remain at an impasse. The strike’s impact on consumers is expected to grow, though the White House has stated that immediate effects on fuel, food, and medicine prices should remain limited for now. The administration continues to emphasize that collective bargaining is the most effective way to reach a resolution that benefits both workers and employers.

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email