Why Tariffs & Why Now?

Trump's tariffs aim to reshape international trade. They target imports from China, Mexico, and Canada

starting February 1.

The president sees tariffs as both a policy tool and a growing revenue stream. By imposing fees on foreign goods, he hopes to protect U.S. industries and encourage fair trade practices. U.S. manufacturers face an uneven playing field when compared to foreign counterparts like those in Mexico and China, due to differences in regulations and quality controls.

For instance, China doesn’t have strict regulations like

OSHA, which ensures worker safety and

environmental standards in the U.S. Additionally, Chinese manufacturers often don't face the same level of quality control scrutiny that domestic manufacturing companies do. These disparities make it difficult to directly compare commodities, as U.S. manufacturers shoulder higher costs to comply with regulations, while foreign manufacturers benefit from fewer restrictions. As a result, domestic manufacturers and distributors struggle to compete on price, which is one of the reasons tariffs are viewed as

protecting national strategic interest.

Jamie Dimon, CEO of JPMorgan Chase, in a CNBC

interview today from Davos, Switzerland, where the World Economic Forum is taking place said, “I would put in perspective: If it’s a little inflationary, but it’s good for national security, so be it. I mean, get over it.”

Tariffs are not new to Trump’s strategy. The trade war with China in 2018 established a framework for using tariffs to gain leverage. This latest round builds on that approach, with broader goals for economic influence.

Tariffs on China: A Bold Move

Tariffs on Mexico and Canada

Mexico and Canada are also in Trump’s sights. He plans to impose 25% tariffs on goods imported from these neighboring countries.

Canadian Prime Minister Justin Trudeau has expressed concerns saying that Canada supplies vital materials like oil, steel, and lumber. He went on to claim that the U.S. Tariffs could disrupt this trade and raise costs for American industries.

Both nations aim to avoid direct trade conflict while protecting their economies from potential damage.

Trump’s tariffs serve multiple purposes. They are designed to pressure trade partners, reduce deficits, and address what he views as unfair practices.

Tariffs also play a role in domestic revenue generation. They are a tax on imported goods, and higher tariffs mean more money for government programs.

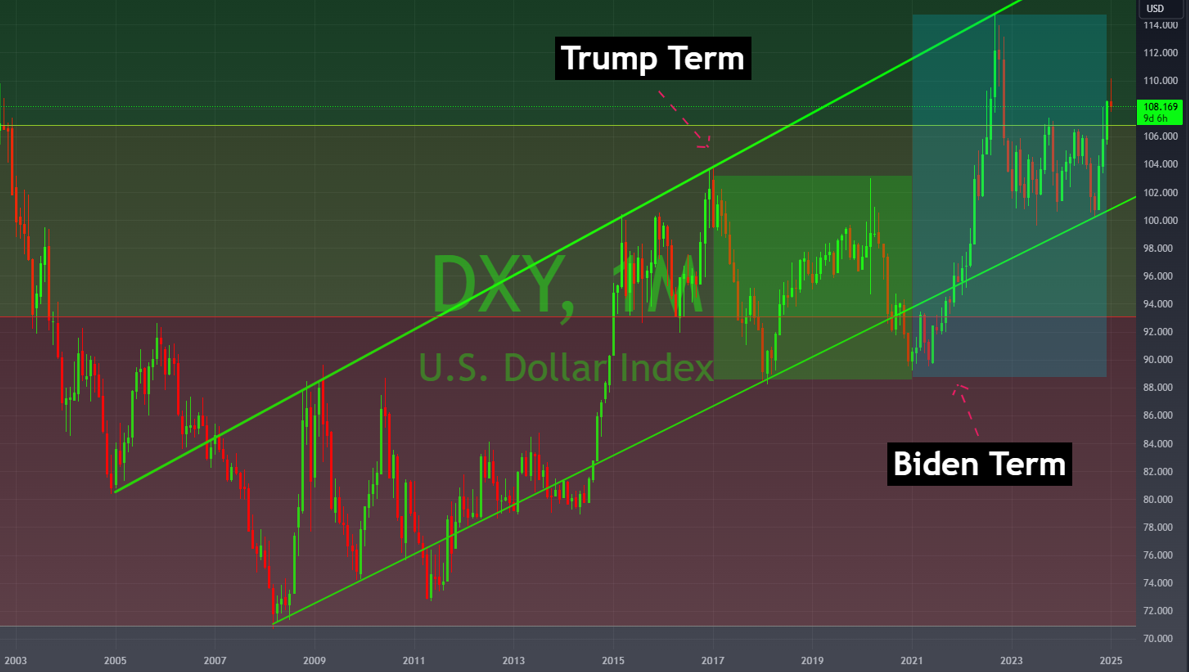

Economists warn of potential downsides, including higher consumer prices. Some argue that the inflationary effects could complicate the Federal Reserve’s plans for interest rate cuts.

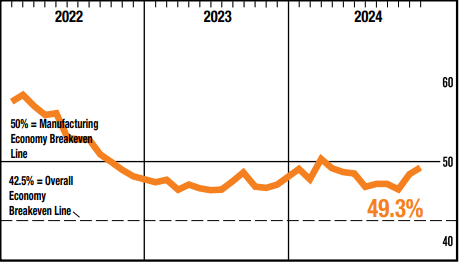

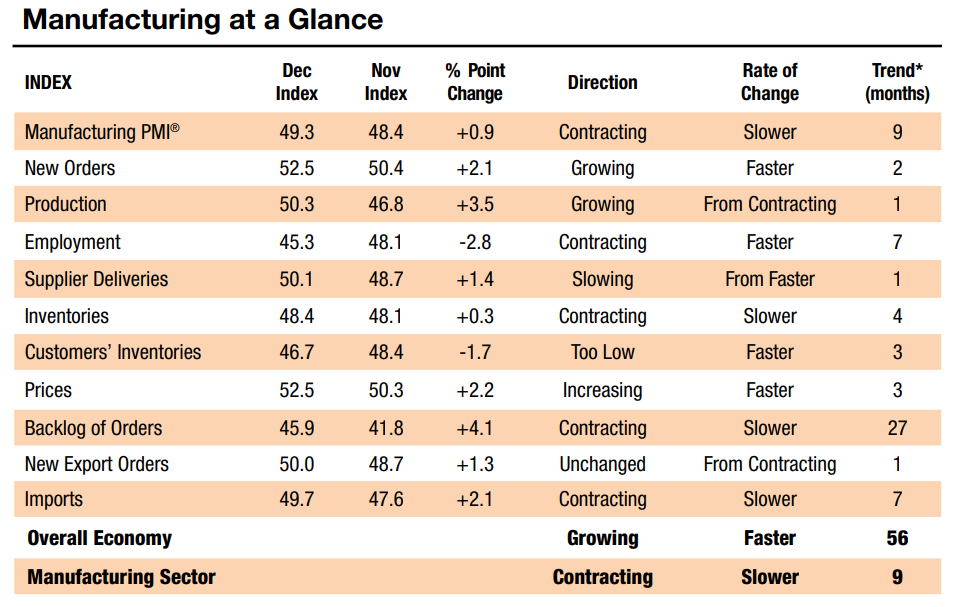

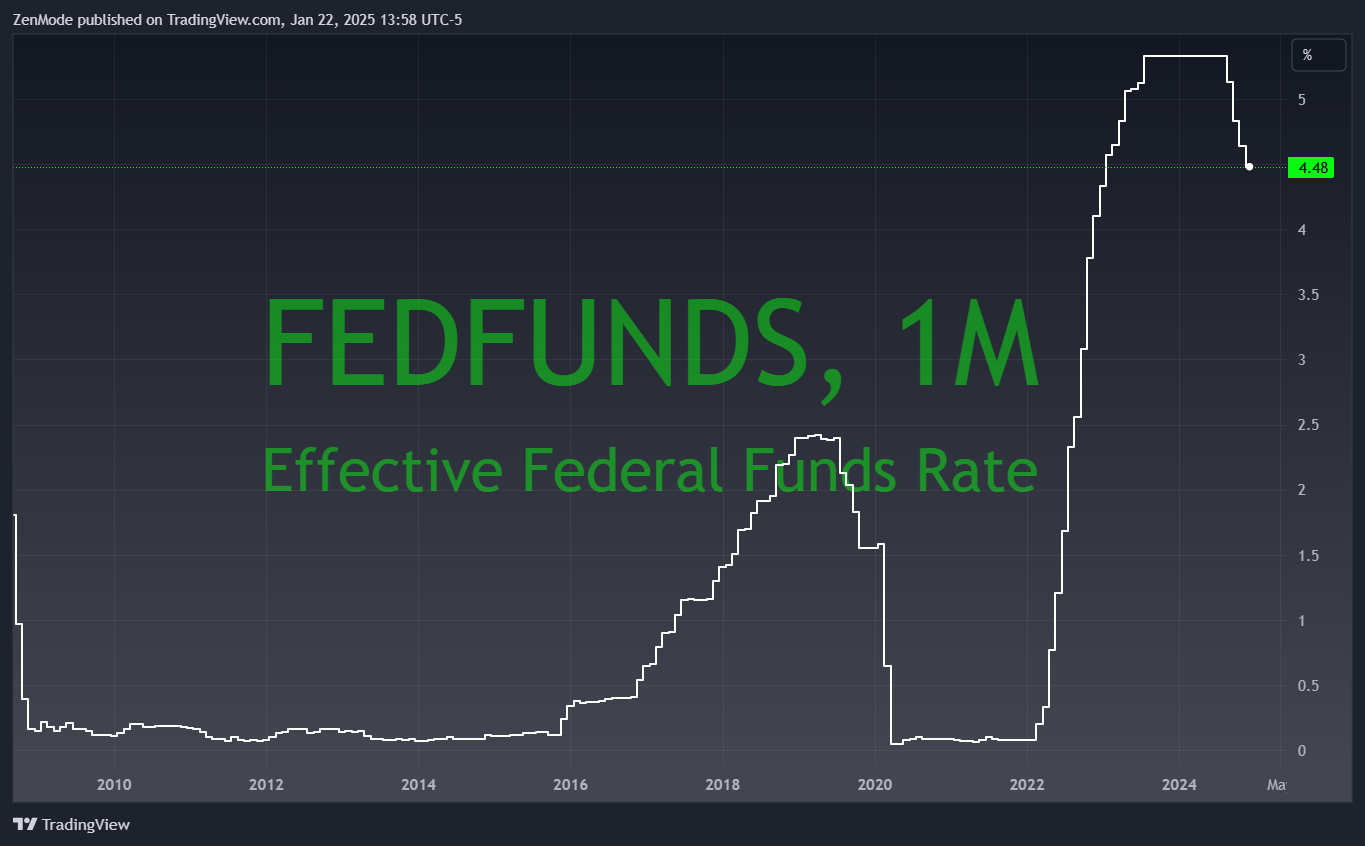

What does the data say concerning Tariffs?

Tariffs are meant to protect U.S. manufacturers by making imported goods more expensive, encouraging people to buy domestic products. However, the strong dollar, driven by high U.S. interest rates and the global demand for U.S. Treasuries, adds a challenge. A stronger dollar makes U.S. exports pricier and imports cheaper, which can undermine the goal of supporting domestic manufacturing. While inflation is coming under control, the Fed’s high interest rates continue to strengthen the dollar, making it harder for tariffs alone to boost manufacturing, especially with rising input costs and increased global competition. An important factor in determining improvement in domestic manufacturing will be a weakening US dollar.