Trucking Tonnage Numbers Increase from January 2024

Tonnage & the Logistics Managers' Index

The trucking industry experienced contrasting freight tonnage trends in February, according to the latest reports. While year-over-year tonnage continued its decline, there were signs of improvement on a month-to-month basis, offering a glimmer of hope for an eventual recovery from the ongoing freight recession.

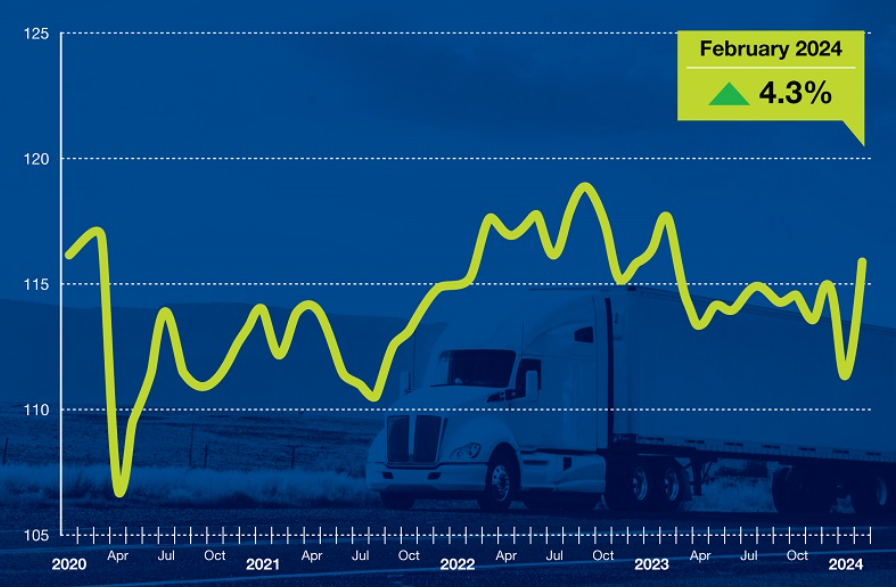

The American Trucking Associations (ATA) For-Hire

Truck Tonnage Index revealed a 1.4% year-over-year drop in tonnage to 116.0 in February, marking the 12th consecutive year-over-year decline. However,

the index showed a 4.3% month-to-month increase from January's reading of 111.3, indicating a potential uptick in freight demand.

Despite the positive month-to-month gain, ATA Chief Economist Bob Costello acknowledged that significant room for improvement remains in the industry. The ATA index primarily reflects contract freight rather than spot market freight, with 100 representing the baseline year of 2015.

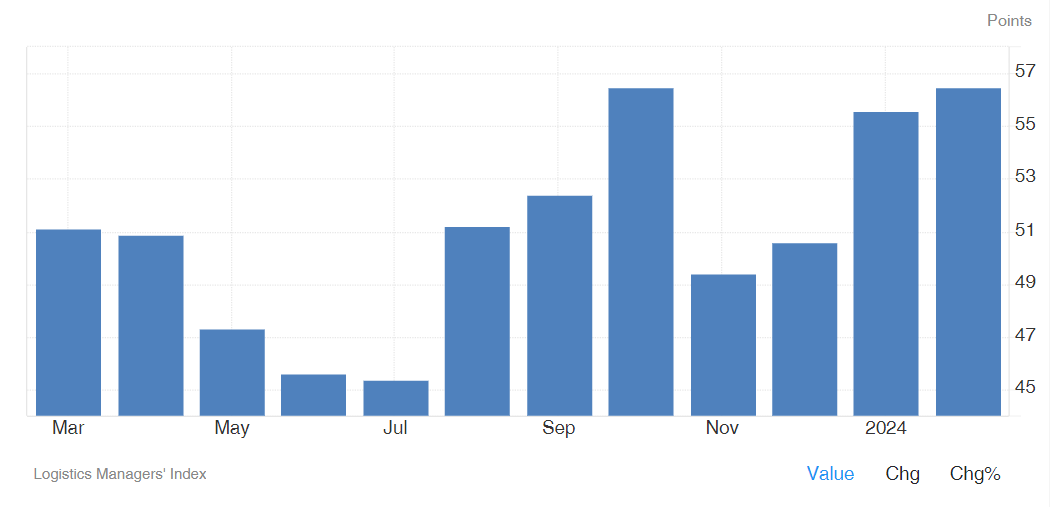

Similarly, the Logistics Managers' Index (LMI) reported a sequential gain, with February's reading increasing by 0.9% to 56.5 from January's 55.6. On an annual basis, the February figure marked a 3.3% improvement compared to the previous year's reading of 54.7. February's result also tied with October 2023 for the highest overall index reading in the past 12 months, bolstered by expansion across all eight sub-metrics captured in the index for the second consecutive month.

Arizona State University Professor of Business Dale Rogers, one of the report's authors, attributed the improvement to several trends that have aided the U.S. economy's post-COVID recovery, including increased domestic energy production.

The report, assembled monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada-Reno, in conjunction with the Council of Supply Chain Management Professionals, considers an LMI reading above 50 as an indication of expansion in the logistics sector, while a reading below 50 signals contraction.

Freight forecast by alternative research have also projected potential freight industry improvement in the second and third quarters. Additionally, several major ports, including Los Angeles and Long Beach, reported strong January and February container volumes, which port officials view as a positive sign for the improving economy.

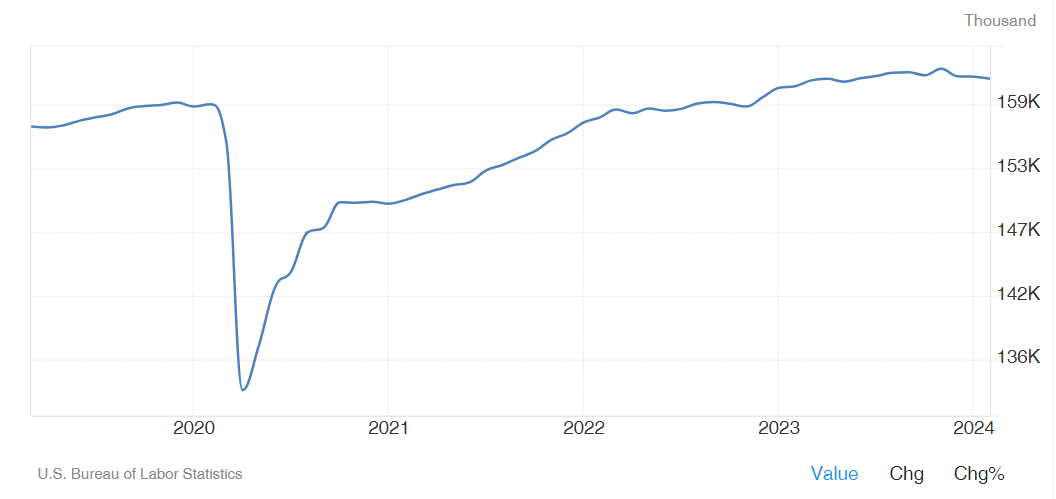

Furthermore, the U.S. labor market showed resilience, with employers adding 275,000 jobs in February, following a revised gain of 229,000 jobs in January. Although the unemployment rate ticked up two-tenths of a point to 3.9%, it marked the 25th consecutive month below 4%, indicating a robust job market.

While the freight industry continues to navigate challenges, the mixed signals in February suggest potential signs of recovery on the horizon, offering cautious optimism for the months ahead.

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email