Transportation Trend - August 2023

Latest Update in Transportation Trends

August 2023

The aftermath of Yellow Corporation followed by what’s to come from the new UPS Contact. Dive into what’s happening the transportation industry.

Yellow Corporation

A week from ceasing operations, Yellow Corporation has officially filed for Chapter 11 bankruptcy. In it’s filing, the company stated $2.15 billion in Assets and $2.59 billion in liabilities. A debtor-in-possession (DIP) financing agreement is expected to take over as Apollo Global Management leads the rumored talks. (Source: FreightWaves)

Yellow Corporation is the largest bankruptcy in US Trucking History after debt overtook the company’s financial position. The final blow came after feuds with Teamsters forced the company to lose business from shippers. The company included regional and national LTL companies such as YRC Freight, Holland, Reddaway, Yellow Logistics (3PL Brokerage), and New Penn Motors.

Small Parcel - UPS Tentative Contract

On the other side of labor negotiations, UPS agreed to a tentative deal valued at $30 billion that gave wage increases, installation of air conditioning in new vehicles, and full-time job openings. The deal comes after talks stalled in beginning of July and negotiations went down-to-the-wire before the August 1 expiration date. The $30 billion will be sourced through customer rate increases that UPS states will be double-digit increase over the next three years.

The deal may have averted a disruptive strike to the supply chain, but the costs are expected to be passed onto shippers. An analyst advised FreightWaves that shippers should expect a 11% to 12% General Rate Increase (GRI) in parcel pricing. Last year, UPS recorded a 9% GRI after all factors were incorporated into their announced 6.9% GRI.

Less-than-Truckload

Networks appeared to be able to handle the volume after shippers shifted from Yellow Freight. This was in part due to the softness of demand and looseness of capacity in the LTL network. T-Force and other LTL carriers are reporting massive increases in daily pickup requests (T-Force +3,000 per day) which will result in higher pricing and/or poorer pickup performance as capacity tightens.

In the upcoming quarter, expect higher rates from LTL carriers with higher volume going through their networks. Request for Pricing (RFPs) from LTL carriers will be unfavorable in the upcoming quarter due to the higher requests.

TLI's customers are insulated from these effects as TLI already has custom pricing and aggressive blanket options with major national and regional carriers. Feel free to reach out to your account manager with any concerns.

Truckload

From June to July, capacity loosened and demand dropped in the truckload network. Summer months prior to 2020 typically have a seasonal trend of being slower as vacation months occur. However, this demand is directly related to a slow-down in demand for consumer goods as our economy works towards correction from inflation.

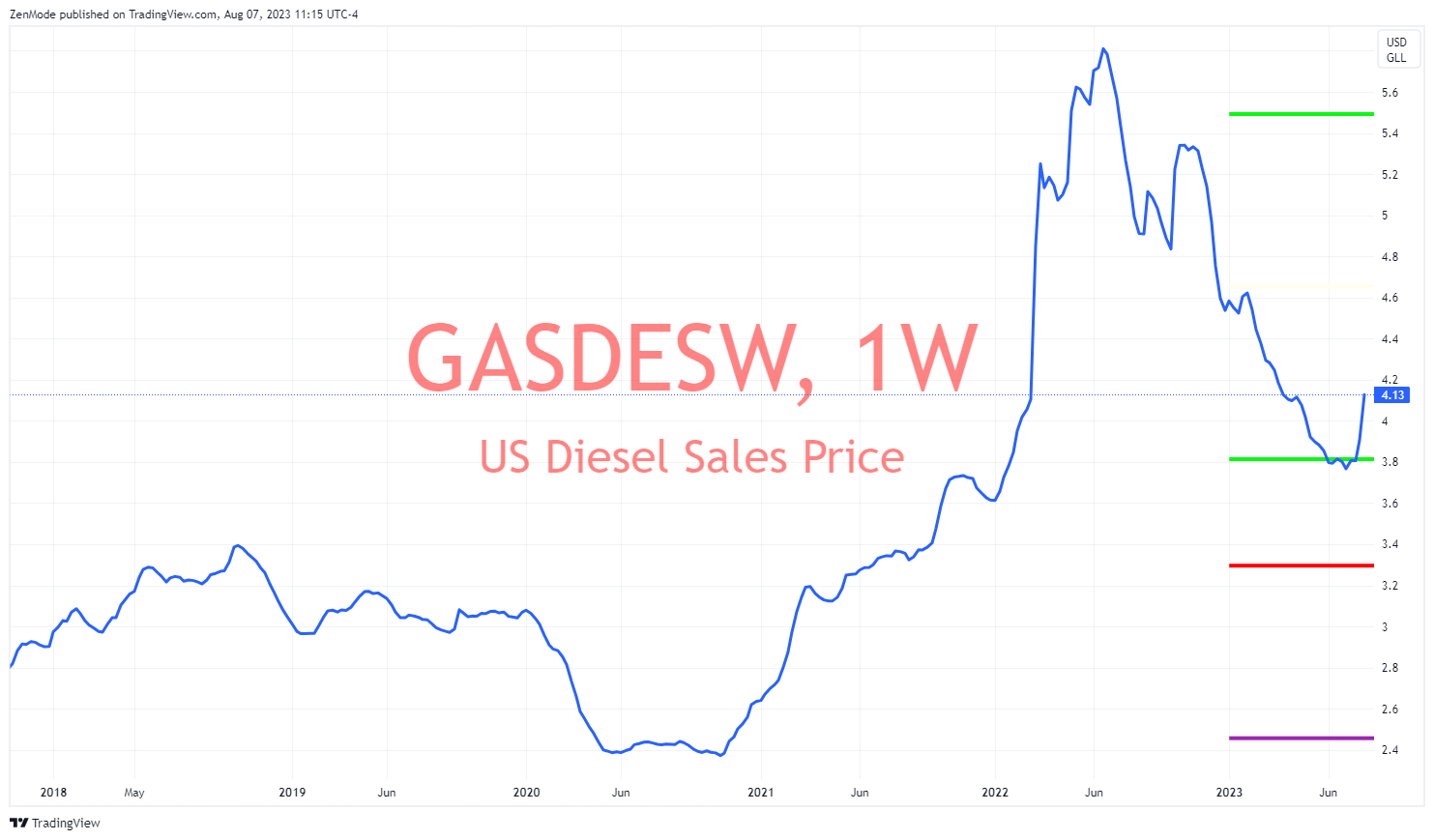

The price of diesel is an emerging topic to be aware of again. Over the past year the pricing trend was dropping off from the all-time highs in 2022. However, over the last two week the price has shot-up 8.5%. View the chart of the week for analysis on the current US Diesel Sales Price.

Chart of the Week

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email