What is a GRI in Shipping?

General Rate Increase

"Help! I'm a shipper and just received a GRI. What should I do?" Before diving into tactics and strategy, let's clarify what a GRI in shipping actually means. In a stable market, GRIs typically occur annually or semi-annually. However, due to the volatile nature of supply and demand in shipping, pricing can fluctuate rapidly.

Shippers generally experienced a steady increase in rates from 2020 to 2021, marked by successive GRIs, followed by a decline in rates in 2022. In 2023, TLI observed a drop in contract TL rates, while LTL carriers continued to seek GRIs. It's important to note that every market is unique, as GRIs are directly influenced by the supply and demand dynamics of shippers. YRC going bankrupt, for example, enabled the LTL carriers to absorb their volume which increased demand on the supply of their trucks. The price is the equilibrium of supply and demand, so if the demand increases along with the carriers cost of operations, then carriers will typically deploy GRIs to cover their bases.

Before strategizing, let's address some fundamental questions to provide clarity on GRIs for shippers.

What is a General Rate Increase?

General Rate Increases (GRIs) entail carriers raising the base rate of freight costs, irrespective of class or additional services provided. Carriers resort to implementing GRIs during periods of escalating operating costs to improve their bottom line. For instance, rising toll prices, maintenance expenses, and driver labor costs may prompt carriers to initiate GRIs to offset these financial burdens.

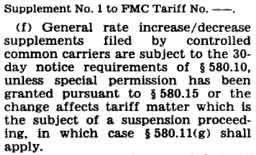

GRI defined according to the code of Federal Regulations of the United States of America, p. 340, 1992.

Are GRI's annual?

Typically, General Rate Increases are scheduled annually to coincide with the anniversary of a known contract. However, the timing of GRIs is entirely at the discretion of the carrier. Here are some reasons why a carrier may decide to review and implement a General Rate Increase:

Rising Operational Costs

Carriers encounter numerous variable costs associated with transporting shipments. Any factor that increases these costs must be balanced to ensure profitability. Factors such as fuel prices, labor expenses, maintenance, equipment needs, and more contribute to this equation.

A prime illustration of this occurred during the UPS Contract Labor Negotiations in 2023. The escalation in labor costs compelled carriers to adjust rates upward to maintain profitability.

Shipper Demand

Price is still a function of demand vs supply. In the transportation market, demand is dictated by shippers' loads while supply is based off the carriers shipping capacity.

When demand exceeds the carrier's capacity to serve, the carrier may increase costs to manage the situation. This approach aims to counterbalance the surging demand and assist carriers in acquiring additional financial resourcesto serve shippers if necessary.

Shipper Profile

During the initial contract negotiations, a carrier might not anticipate all the costs associated with servicing a shipper. Factors such as a guard shack, high claims ratio, excessive length, proper handling, loading/unloading times, additional accessorial services, and more could necessitate the carrier to adjust costs upward.

Help! As a shipper, I've received notice of a General Rate Increase! What should I do?

TLI provides specialized services aimed at helping shippers alleviate the impact of LTL GRIs, offering three distinct examples tailored to different shipper profiles:

- Using our TMS rating engine, we can simulate scenarios to precisely measure the GRI's effect on your freight expenses. By analyzing historical shipments under the new carrier GRI contract, you'll gain a clear understanding of the expected costs.

- Through Load Optimization in our dynamic rating engine, we guarantee the sorting of least cost provider. Freight carriers are opting out of loads if the GRI no longer makes them the most cost-effective provider, thus preserving shipping cost efficiency.

- We can initiate a customized shipping RFP (Request for Proposal) if your transportation expenditure justifies it. This process involves compiling historical data and creating a comprehensive template tailored to your needs as a shipper, covering aspects such as cargo liability, accessorial needs, claims ratio, packaging type, commodity handling, stowability, lane frequency, freight class range, and density study— TLI constructs comprehensive shipper profiles and develops tailored programs to meet the specific needs of each shipper.

In addition, TLI offers a fourth bonus option:

staggering custom contracts. This entails negotiating with primary national and regional carriers, then revisiting negotiations six months later to ensure a diverse range of market pricing. This strategy provides a contingency plan, ensuring stable pricing even if a primary national LTL carrier enforces a sudden GRI.

General Rate Increases

When demand exceeds the carrier's capacity to serve, they may raise costs to manage the situation. This practice aims to counterbalance rising shipping demand and assist carriers in acquiring additional financial support if necessary. Carriers strategically implement general rate increases due to various factors, such as inflation-driven cost escalations, higher wages for drivers, equipment maintenance expenses, and the identification of additional accessorial services needed to handle shippers' freight.

Why are LTL GRIs different than FTL GRIs?

In 2024, the timing of the freight market raises an important question. While Truckload Rates are highly sensitive to market conditions, the LTL environment operates differently and doesn't necessarily coincide with Truckload Rates. The full truckload market is largely made up of small businesses; 90% of truckload companies operate with 6 or less trucks. The LTL market features a higher barrier to entry, so it is dominated by fewer companies, which generally keeps prices higher compared to Truckload Carriers.

While the LTL market's lesser sensitivity to market conditions is a valid consideration, another significant factor comes into play. LTL Carriers persist with General Rate Increases (GRIs), irrespective of the state of freight markets, due to significant competitor fallout and escalating operational costs.

Following the collapse of Yellow Freight, LTL Carriers acquired substantial business volumes, necessitating investments in additional equipment and terminal space. Fortunately for LTL carriers, Yellow Freight's network collapsing provides an opportunity for this expansion. However, implementing these LTL network changes will take time, prompting LTL carriers to continue with GRIs in the interim.

General Rate Increase FAQ

How do I control my GRI?

While General Rate Increases (GRIs) are inevitable for carriers, shippers have options to mitigate costs. Temporarily shifting freight to an alternative carrier can offer relief from GRIs, although to properly template and launch the RFP with regional LTL participation will be neccesitated through collaboration with Translogistics.

Collaborating with a Third-Party Logistics Provider (3PL), such as TLI, enables shippers to access a broader range of regional carriers. The flexibility to switch between carriers with the dynamic routing guide helps mitigate costs for individual shipments.

What are GRI negotiation suggestions?

Shippers have many options to navigate through GRIs including:

- Compare freight quotes

- Compare altnerative modes of transportation

- Diversify your distribution points

- Assess profitability prior to ordering inbound raw material

What is an international GRI in logistics?

A general rate increase (GRI) is a sea freight rate adjustment across all or specific trade routes within a defined period. GRIs typically stem from supply and demand dynamics in freight shipping and are commonly instigated by major carriers.

What is GRI implementation in the shipping industry?

A General Rate Increase (GRI) is a standardized adjustment in the base rates employed by logistics and shipping firms for transporting goods. It uniformly applies across different shipping routes, known as trade lanes, impacting all customers utilizing those routes.

What does GRI stand for in shipping?

GRI in domestic shipping means 'General Rate Increase'. In international shipping, customs defines GRI as 'General Rules of Interpretation'.

What is an LTL GRI?

Less-than-truckload carriers utilize General Rate Increases (GRIs) to adjust base rates. These increases affect general tariff codes and vary based on lane and weight tier. For instance, a carrier might announce a 4% GRI, but without partnering with TLI and using a rating engine that considers the all-in pricing of past shipments by lane, shippers may not fully comprehend the impact. Each lane and weight tier is priced differently, so by teaming up with TLI, we can compare historical data against the GRI. This allows us to explore new carrier options and implement a dynamic routing guide to reduce or even generate savings instead of absorbing a significant rate hike.

Are you a shipper needing GRI support?

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email