Declining Freight Demand & Truck Driver Compensation

Weak FTL Demand Impacts Driver Pay

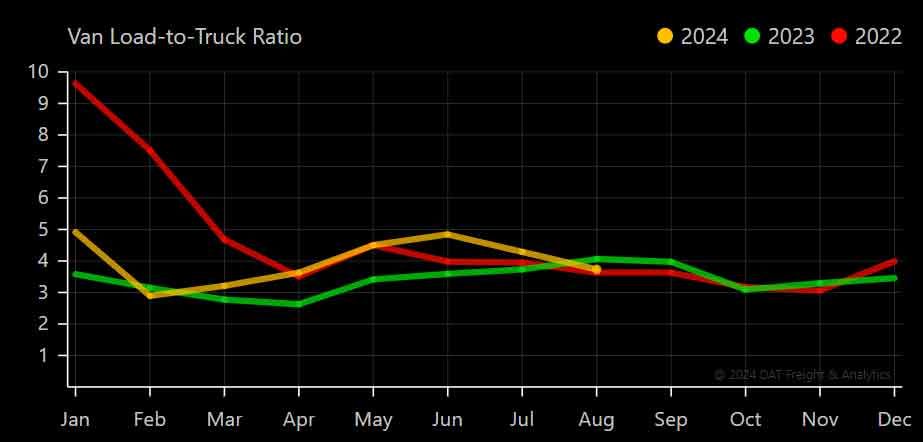

The load-to-truck ratio measures how many loads are available for every truck listed on the DAT Load Board. It’s a real-time indicator of the balance between demand (loads) and supply (trucks) in the spot market.

When the ratio is high, it usually signals higher rates, as there are more loads than trucks. Conversely, a low ratio means more trucks are available than loads, leading to lower rates.

Load-to-Truck Ratio

To calculate this ratio, DAT divides the number of load posts by the number of truck posts. A rising ratio occurs when there are more loads or fewer trucks available, while a declining ratio happens when there are fewer loads or more trucks. In simple terms, the higher the load-to-truck ratio, the higher the demand for trucks, which can drive up rates.

Currently, the market is experiencing low demand and an oversupply of trucks, causing the ratio to drop. This imbalance has led to pricing softness, negatively affecting truck driver wages.

Truck Driver Wages

Truck driver compensation refers to the wages and benefits that truck drivers receive for transporting goods. This includes base pay, often calculated per mile or per hour, as well as bonuses and additional earnings for tasks like loading, unloading, or hauling specialized freight. Compensation varies based on the type of driver (company drivers, owner-operators, or leased drivers), experience, and the equipment or freight they handle. There likewise is compensation nuance based upon the operating authority the driver is using. Proper compensation is essential for maintaining a stable and efficient workforce in an industry that is demanding and often faces labor shortages.

Competitive compensation is crucial for attracting and retaining drivers, which directly impacts the operational efficiency of trucking companies. Adequate pay reduces driver turnover, increases job satisfaction, and helps shippers avoid costly disruptions in their supply chains. When drivers are fairly compensated, they are more likely to remain in the industry, allowing businesses to maintain smooth operations and meet delivery deadlines consistently. This stability is vital to keep supply chains running efficiently and prevent delays or increased costs for businesses.

Finally, truck driver compensation influences the overall competitiveness of trucking companies. In a fluctuating market with varying freight demand, companies offering competitive wages are better positioned to secure skilled drivers and maintain their business momentum. Compensation also affects the cost of goods, as freight costs are a significant part of the supply chain. Fair and transparent pay models help companies retain drivers and improve recruitment efforts, making them more competitive in a challenging industry.

Driver Compensation Trends

The Q2 2024 Driver Pay Trend Tracker Report reveals a significant decline in truck driver compensation, particularly in starting pay. According to the report, company drivers experienced a 7.4% reduction in their average weekly pay, which fell from $1,730 in the first quarter to $1,602. Owner-operators also saw a decrease, with their earnings dropping by 2.2% to $4,500. These declines are primarily attributed to reduced freight demand and increased capacity in the trucking market, which have lessened the need for new drivers.

While most compensation metrics showed declines, leased-purchased transportation was a notable exception. The report highlighted a 1.9% increase in weekly pay for this segment, which rose from $2,300 in the previous quarter to $2,343. This increase contrasts with the broader industry trend, as both company drivers and owner-operators saw their pay fall when compared to the third quarter of 2023. Reduced freight demand has resulted in fewer miles driven per truck day, which has directly impacted driver earnings. Moreover, many carriers have paused sign-on bonuses as part of their recruiting efforts, a move driven by declining financial results across the industry.

Shipper Demand Impacts $/m

Despite the drop in overall pay, per-mile or per-hour rates have not been significantly reduced. Instead, the decline in earnings stems from reduced operations, which limits the miles available for drivers to work. In addition to lower demand, layoffs have been reported across several segments of the trucking industry, particularly in less-than-truckload and refrigerated services. This shift has prompted carriers to focus more on driver retention, placing greater emphasis on supporting existing drivers in an effort to mitigate turnover and maintain their workforce.

Future improvements in driver compensation remain uncertain and are largely dependent on market conditions. Many industry experts agree that wages are unlikely to recover until freight demand stabilizes. However, the current market downturn presents an opportunity for carriers to refine their recruitment and retention strategies, positioning themselves to succeed when the industry rebounds. By enhancing their internal processes and support systems, forward-thinking motor carriers can prepare for a resurgence in freight demand.

Larger carriers have been able to maintain incentives for their drivers by leveraging their financial stability and contract commitments. These companies continue to offer higher pay for specialized roles, such as drivers hauling hazardous materials, as well as additional compensation for tasks like unloading trailers. During the pandemic, many carriers offered sign-on bonuses to attract drivers, but they have since shifted to more transparent pay-per-mile models, which simplify recruitment and provides a clearer compensation structure for prospective drivers.

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email