Cargo Claim Deadlines of 120 Days Under the Carmack Amendment

Key Steps and Deadlines for Filing Cargo Claims

Understanding the deadlines and procedures for filing cargo claims is essential to protect your company's financial interests. Under the Carmack Amendment, which primarily governs interstate shipments, there are specific federal guidelines that must be followed when handling cargo claims. Misunderstanding these rules can lead to costly mistakes, so it's important to be aware of the key timelines and legal requirements.

The following information is for educational purposes only.

Why Properly Filing a Freight Claim Matters

Filing a freight claim correctly can save your company both time and money. A freight claim is a legal demand for compensation due to a breach of a contract of carriage, typically involving lost or damaged goods. To ensure your claim is handled effectively, you must follow strict guidelines. There are four crucial elements to a successful freight claim:

- Identify the Shipment: This allows the carrier to begin an investigation.

- Specify the Type of Loss or Damage: Clearly describe what went wrong.

- Estimate the Claim Amount: Provide a reasonable estimate of the financial loss.

- Demand Payment from the Motor Carrier: Make it clear that you are seeking compensation.

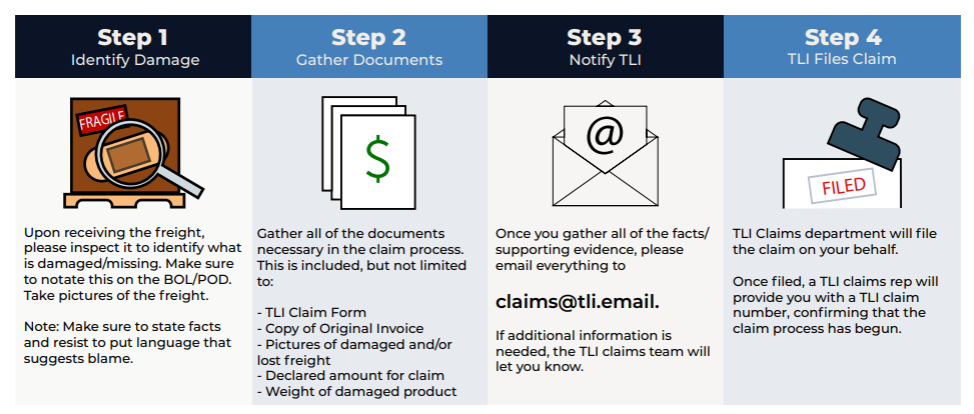

Once you've addressed these elements, you can follow the steps outlined below to ensure your freight claim is processed smoothly.

Taking Immediate OS&D Action

The first step in filing a freight claim is to act quickly. Freight claims for loss or damage are governed by Title 49, CFR. Claimants must file the claim within the time limits specified in the Bill of Lading or contract of carriage. Typically, this period cannot exceed 9 months from the date of delivery or the expected delivery date if the goods were never delivered. If the contract doesn’t specify otherwise, the carrier must acknowledge receipt of the claim within 30 days. The carrier then has 120 days to pay, offer a compromise, or disallow the claim. If the claim isn’t resolved within this period, the carrier must provide status updates every 60 days. If the carrier fails to follow these rules, notify them that they are violating FMCSA regulations.

If damages were not noted on the delivery receipt at the time of delivery, you have only 5 days to inform the carrier of concealed damage. After this window, the carrier can deny the claim, arguing that the shipment was signed as clear.

Mitigating the Damages

When dealing with cargo claims, one of the most crucial responsibilities is mitigating damages. Shippers must make a good-faith effort to salvage any damaged products unless they are considered totally or substantially useless. Shipments that are lost in transit, are easier to resolve and result in much larger settlement sums. Both shippers and carriers share this responsibility to ensure that losses are minimized. The way damages are handled can significantly influence the settlement amounts, and the timeliness of your actions plays a vital role.

Lost Shipments: The Impact of OS&D and APB Searches

For shipments lost in transit, the stakes are often higher. In such cases, Over, Short, and Damaged (OS&D) reports are typically generated to identify discrepancies. If an OS&D report fails to locate the missing shipment, an All-Points Bulletin (APB) search is initiated. This extensive search aims to recover the lost goods by notifying all possible points in the transportation network.

However, if the shipment remains unlocated after the APB search, the resulting freight claim settlement is often significantly higher. This is because a lost shipment represents a total loss for the claimant, making the settlement potentially much swifter and larger as a percentage of the claimed amount.

Concealed Damage: The Urgency of Notification

In contrast, when dealing with concealed damage—damage that is not immediately visible at the time of delivery—the rules are stricter, and time is of the essence. The claimant must notify the carrier of the damage within 5 days of delivery. Every day that passes after this 5-day window can lead to a reduced settlement percentage. This is because the longer the delay in reporting the damage, the more difficult it becomes to prove that the damage occurred during transit with the motor carrier and not after delivery.

For instance, if you notice concealed damage but wait 10 days to notify the carrier, the chances of any settlement at all are significantly reduced. The motor carrier may argue that the damage could have occurred after delivery, and as a result, they might offer a lower settlement or even deny the claim altogether.

The Importance of Immediate Action

To mitigate damages effectively, it’s crucial to act swiftly. If you suspect any damage or loss, you should immediately document it and report it to the carrier. Quick actions not only preserve your rights to a fair settlement but also demonstrate your good faith effort to resolve the issue. Moreover, in cases of lost shipments or concealed damages, timely notification and proper documentation are key to securing the best possible outcome in your cargo claim.

Whether dealing with a lost shipment or concealed damage, working with an experienced freight claims management partner, like Translogistics (TLI), can make a significant difference. We can assist shippers throughout the claims process, ensuring that you meet all deadlines and maximize your settlement potential.

Providing Additional Documentation

To support your freight claim, always include relevant documentation. This might include the original Bill of Lading (BOL), paid freight bills, inspection reports, notifications of loss, copies of inspection requests, invoices, and waivers. Some carriers may also require photographic evidence of the damage. The more detailed the information you provide, the stronger your claim will be.

Create a Detailed Description of the Losses or Damages

When filing a freight claim, it's essential to provide a clear and detailed description of the losses or damages. This includes specifying the number of items affected, the nature of the damage, the value of each item, and the total claim amount. Here's a Freight Claim example:

- 1 box of mold equipment – (damaged by impact) @ $7,500 each: $7,500

- 5 boxes of plastic resins – (water damaged) @ $500 each: $2,500

Total Damages: $10,000

If one box of the plastic resins was salvageable, you should subtract its value from the total:

- Amount Salvaged: $500

Total Claim Amount: $9,500

By documenting the damages in this way, you ensure that your claim is clear and well-supported. This level of detail can significantly improve the chances of a successful claim. Freight losses and damages are inevitable if you frequently ship LTL or truckload freight, making it essential to have a reliable freight management partner. At Translogistics (TLI), we can assist you with filing and processing your freight claims, ensuring you find carriers that best represent your interests. Contact us today to learn more.

Clarity and Understanding of the Carmack Amendment

To better understand the Carmack Amendment, it’s essential to know some key terms related to cargo transportation, as these terms are crucial in determining Carmack’s applicability.

Here are the most important legal terms:

Parties Involved in Cargo Transportation

- Broker: Defined by federal transportation laws, a broker is someone who, as a principal or agent, sells, offers, negotiates, or arranges transportation by a motor carrier for compensation. Brokers are not subject to Carmack liability (Chubb Group of Ins. Cos. v. H.A. Transp. Sys., 243 F. Supp. 2d 1064, 1069 (C.D. Cal. 2002)).

- Carrier or Common Carrier: A "carrier" includes motor carriers, water carriers, and freight forwarders, as outlined in 49 U.S.C. §13102(3) (2005).

- Motor Carrier: A motor carrier is defined as a person providing transportation of goods by commercial motor vehicle for compensation.

- Private Motor Carrier: According to the ICC Termination Act of 1995, a private motor carrier is someone, other than a motor carrier, who transports property they own, lease, or are responsible for, using a commercial motor vehicle in interstate or foreign commerce. Private carriers are not considered motor carriers under Carmack, so shippers cannot recover damages from them under this law.

- Consignee: The person named in a bill of lading to whom the goods are delivered.

- Consignor: The person named in a bill of lading from whom the goods are received for shipment.

- Shipper: Also known as the "consignor," this is the party providing the goods to be transported.

Documents Used in Cargo Transportation

- Bill of Lading: Governed by the Bills of Lading Act, a bill of lading is a transportation contract between the shipper-consignor and the carrier. It represents the title of the goods and serves as evidence of the carrier’s receipt of goods, their condition at the time of receipt, and their nature and quantity. Under Carmack, carriers and freight forwarders must issue a receipt or bill of lading for property received for transport, although failing to do so doesn’t affect their liability.

- Tariffs: Tariffs detail the rates, charges, classifications, rules, regulations, and practices of carriers. Before 1995, motor carriers had to file tariffs with the Interstate Commerce Commission unless they had a contract with the shipper. Now, only transportation of household goods or property in non-contiguous domestic trade requires tariffs filed with the Surface Transportation Board.

Carmack Amendment Liability

The Carmack Amendment holds motor carriers transporting cargo in interstate commerce strictly liable for "actual loss or injury to property." This means carriers are responsible for damages up to the actual loss of the goods, providing certainty for both shippers and carriers and helping carriers assess risks and predict potential liability.

Under Carmack, shippers have a single method of recovery directly from the interstate common carrier responsible for their damaged goods. The carrier’s liability is governed by the bill of lading used during shipment, with limits based on the carrier’s rates or tariffs. However, Carmack’s liability is not limited to physical damage; it also covers injury to or invasion of property rights and economic loss not directly tied to physical damage.

For a carrier to limit its liability under Carmack, it must:

- Maintain a tariff, if required.

- Obtain the shipper’s agreement on their choice of liability.

- Provide the shipper a reasonable opportunity to choose between different levels of liability.

- Issue a receipt or bill of lading before the goods are transported.

Carmack generally applies when motor carriers and surface freight forwarders must issue receipts and bills of lading for interstate transportation or transportation services.

Key Deadlines Under the Carmack Amendment

When dealing with cargo claims under the Carmack Amendment, it's essential to understand the federal deadlines and timeframes for filing claims, investigating them, responding, and initiating lawsuits. These rules are often misunderstood, especially regarding time limits.

The Carmack Amendment, first enacted in 1906 as part of the Interstate Commerce Act of 1887, is now incorporated into the Interstate Commerce Commission Termination Act of 1995 (ICC Termination Act). This amendment, found in 49 U.S.C. §14706, created a standardized legal framework for interstate shippers to seek compensation from motor carriers and freight forwarders for actual loss or damage to goods.

Under Carmack, carriers are protected from claims that could hold them liable for damages exceeding the value of the goods, as long as specific conditions are met. So the Carmack amendment, now upheld by the ICC Termination Act, essentially codifies the common law principle of strict liability, holding carriers responsible for lost, damaged, or delayed goods in interstate commerce without requiring proof of negligence. Additionally, Carmack overrides state and common law in cases involving such incidents.

Contracts Matter: Cargo claim deadlines can be set or modified by contracts between motor carriers, brokers, freight forwarders, and shippers. Review the Bill of Lading, Terms & Conditions, and other relevant contracts to identify any specific deadlines.

Filing Cargo Claims (49 U.S.C. § 14706(e)(1)): The Carmack Amendment allows motor carriers to set deadlines for filing cargo claims. However, it prohibits requiring claims to be filed in less than 9 months. If the Bill of Lading specifies a 6-month deadline, it is unenforceable. It’s a common misconception that the Carmack Amendment mandates a 9-month deadline—it does not.

Acknowledgment of Cargo Claims (49 CFR § 370.5): Upon receiving a properly filed cargo claim, the motor carrier (or its agent, such as an insurance adjuster) must acknowledge receipt in writing within 30 days. The carrier must also specify any additional documents or information needed to process the claim.

Investigation of Cargo Claims (49 CFR § 370.7): Motor carriers are required to investigate cargo claims "promptly." While prompt isn’t strictly defined, the next deadline—120 days—suggests that the investigation should be completed within this period.

Payment, Declination, or Settlement Offer (49 CFR § 370.9): Within 120 days of receiving a claim, motor carriers must either pay, decline, or make a firm settlement offer in writing. If the claim cannot be resolved within this timeframe, the carrier must inform the claimant of the claim's status and the reasons for the delay. This notification must be repeated every 60 days until the claim is resolved.

Filing Lawsuits for Cargo Claims (49 U.S.C. § 14706(e)(1)): The Carmack Amendment allows motor carriers to set deadlines for filing lawsuits related to cargo claims. If no deadline is specified in the contract, the filing deadline is typically governed by the state’s law for similar lawsuits. However, the Carmack Amendment stipulates that carriers cannot require lawsuits to be filed in less than 2 years.

Freight Claim Outsourcing

Shippers can save time and avoid the complexities of freight claims management by delegating the entire process to Translogistics, ensuring expert handling and faster resolutions. For freight brokers, CoBrokerPro offers a easy way to outsource claims management, allowing you to focus on core business operations while we take care of the details.

TLI Insights

Get the latest logistics insights and tips from Translogistics’ award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@tli.email